It's Free to Try!To be effective, your paycheck calculator is going to have to do more than just calculate hourly wages In fact, it should do a lot more In addition to calculating your employee's hourly wages, it needs to be able to include tax information, additions, deductions, and adjustments Still, you can't simply buy the most advanced system out there and help your business's bottom lineUse the TurboTax® SelfEmployed Expense Estimator to find common selfemployment tax deductions, writeoffs, and business expenses for 1099 filers Get ideas on common industryspecific business expenses people in your profession use Start for free today to see how much you can increase your tax savings

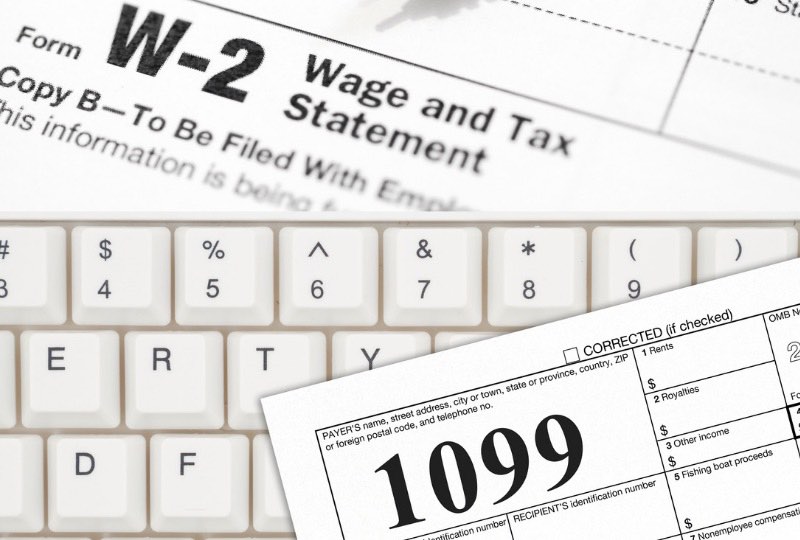

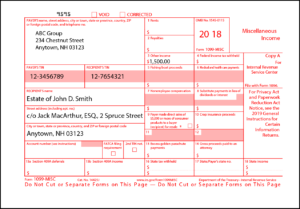

What Is A 1099 Form And How Does It Work Ramseysolutions Com

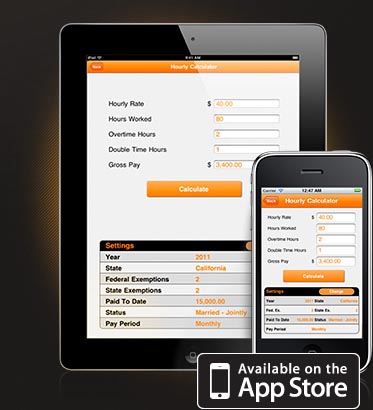

Paycheck calculator for 1099 employees

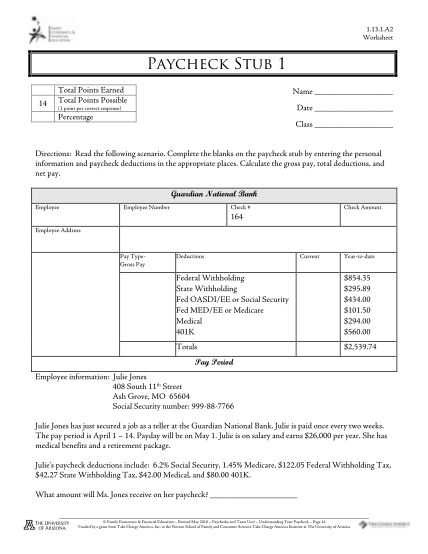

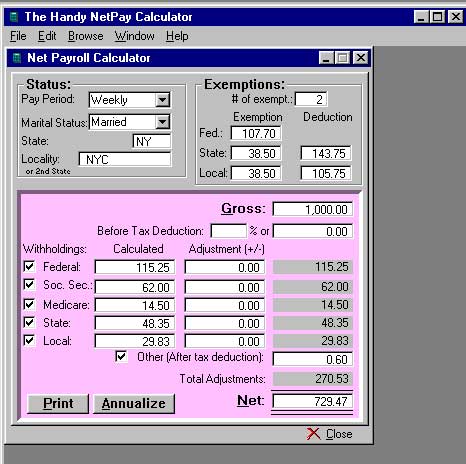

Paycheck calculator for 1099 employees- This will help you make sure you have the right amount of tax withheld from your paycheck There are several reasons to check your withholding Checking your withholding can help protect against having too little tax withheld and facing an unexpected tax bill or penalty at tax time next year At the same time, you may prefer to have less tax withheld up front, so you8 FREE payroll calculators for you and your employees If you're looking to calculate payroll for an employee or yourself, you've come to the right place Whether it's W4 deductions, grossup or tip taxes, these payroll calculators are an easy way to work out or check the accuracy of a payroll calculation Go ahead Try them out

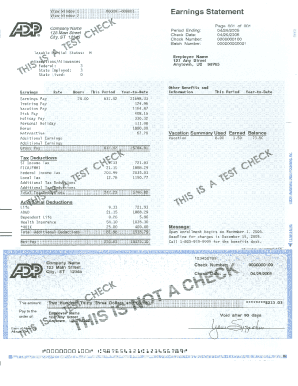

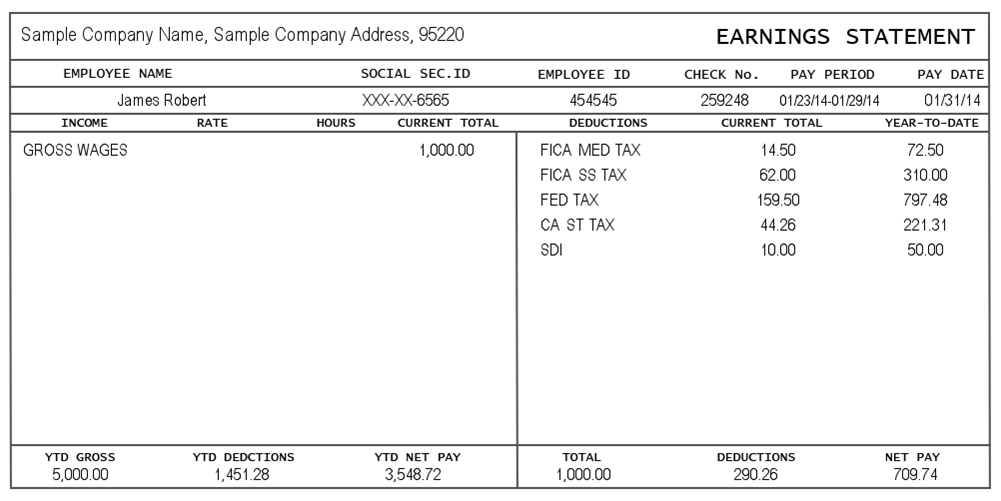

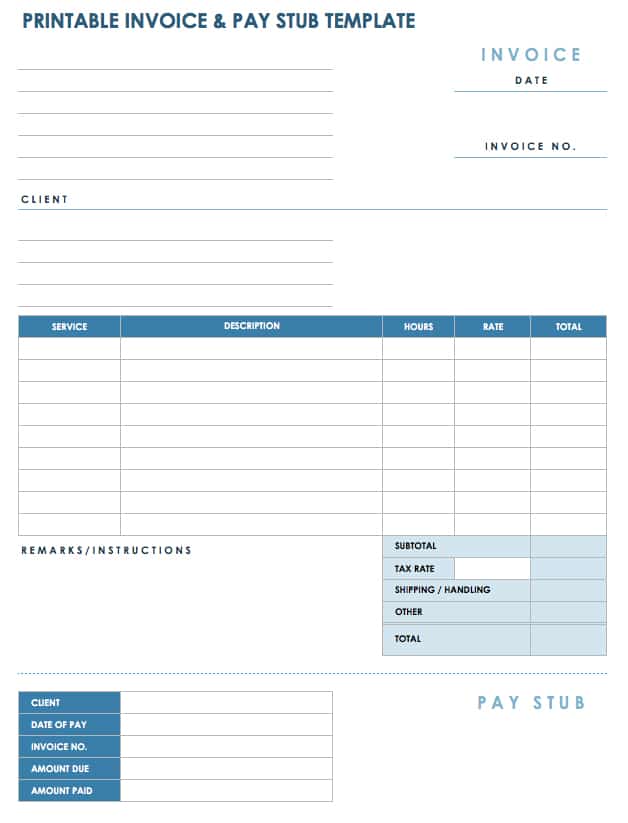

Hourly Wage Then Log Download Pay Stub Template Word Free Inside Free Pay Stub Template Word Cumed Org Templates Word Free Word Template

Profil Visi, Misi dan Tujuan;Calculate your selfemployment taxes now This is true even if you are paid in cash and do not receive a 1099MISC Keep in mind, you may be able to offset this income if you have qualifying expenses SelfEmployment Tax Calculation 19 Your Self Employment Income for $ Your Employer Paid Income for $ Calculate About About TaxAct Product Guarantees Press CenterFree Paycheck Calculator Hourly & Salary SmartAsset Rentals Details FICA contributions are shared between the employee and the employer 62% of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 62%However, the 62% that you pay only applies to income up to the Social Security tax cap, which for 21 is $142,800 (up from

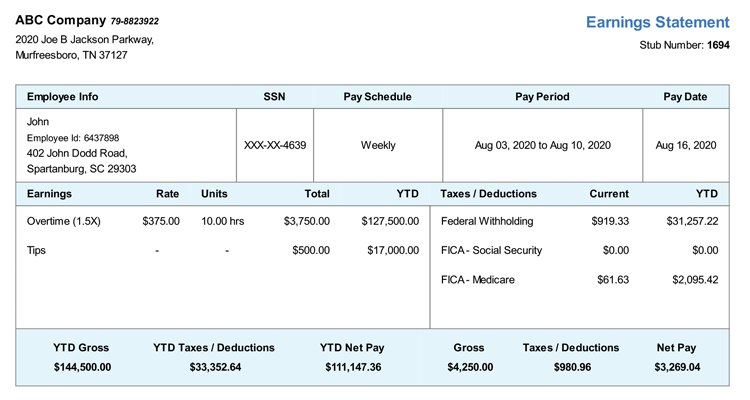

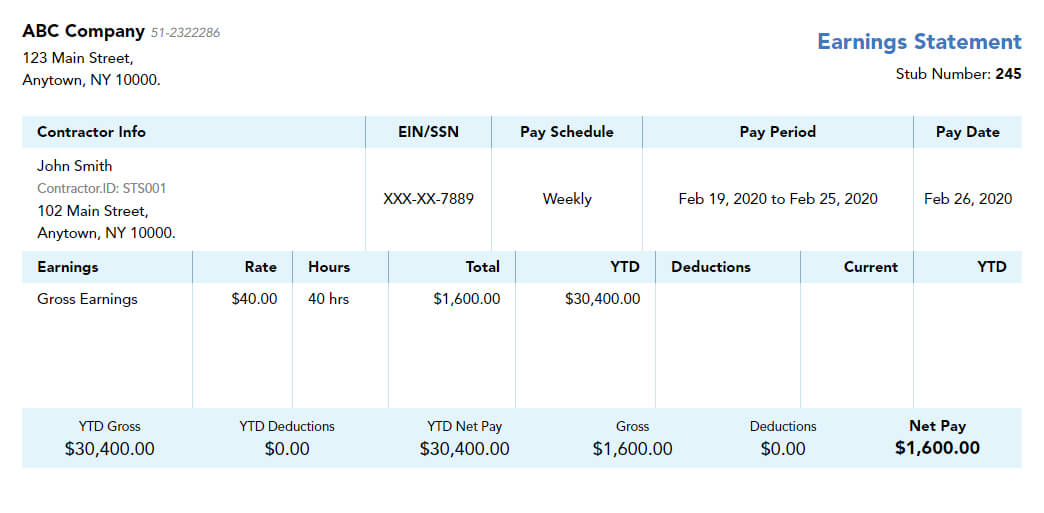

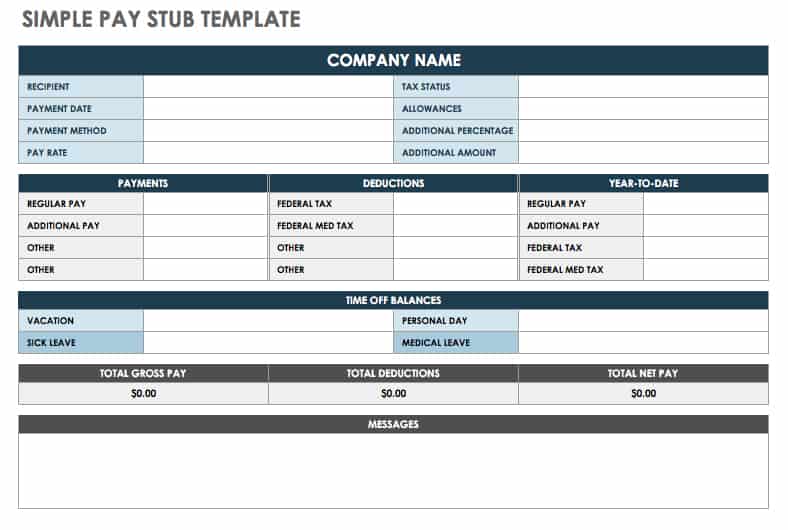

Yes No Employee Income Estimate your W2 income for the whole year $ Work mileage Estimate the number of miles you drive for work for the whole year milesThe Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time ZenPayroll, Inc, dba Gusto ("Gusto") does not warrant, promise or guarantee that the information in the Paycheck Calculator is accurate or complete, and Gusto expressly disclaims all liability, loss or risk incurred by employers or employees as a direct or indirect consequence ofAdd 'yeartoprevious period' information that ensures the calculation accuracy;

Self employment taxes are comprised of two parts Social Security and Medicare You will pay 62 percent and your employer will pay Social Security taxes of 62 percent on the first $128,400 of your covered wages You each also pay Medicare taxes of 145 percent on all your wages no limit If you are selfemployed, your Social Security taxIt's Free to Try!21 Posts Related to Free Pay Stub Template For 1099 Employee 1099 Employee 1099 Pay Stub Template Pdf Pay Stub Template For 1099 EmployeeCreating a budget is a responsible decision By calculating your paycheck, you can determine the amount of money you will have and designate it to specific bills and savings Calculating your paycheck requires the knowledge of your

.gif)

1099 Taxes Calculator Estimate Your Self Employment Taxes

Esmart Paycheck Calculator Free Payroll Tax Calculator 21

This paycheck calculator will help you determine how much your additional withholding should be Another way to manipulate the size of your paycheck and save on taxes in the process is to increase your contributions to employersponsored retirement accounts like a 401(k) or 403(b) The money you put into these accounts is taken out of your paycheck prior to its taxation By putting1099 Tax Calculator A free tool by Everlance Tax filling status Single Married State* SelfEmployed Income Estimate your 1099 income for the whole year $ Advanced (W2, miles, etc) Do you have any employee jobs? 1099 Contractors and Freelancers Most sharing economy workers are 1099 contractors for tax purposes These individuals are also interchangeably referred to as independent contractors or freelancers The IRS taxes 1099 contractors as selfemployed And, if you made more than $400, you need to pay selfemployment tax

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

Pay Stub Generator Free Printable Pay Stub Template Formswift

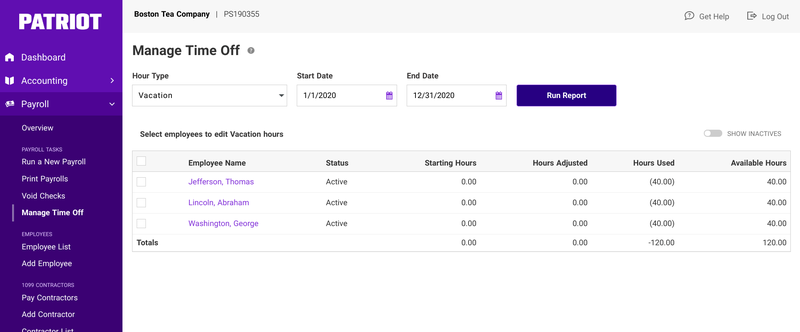

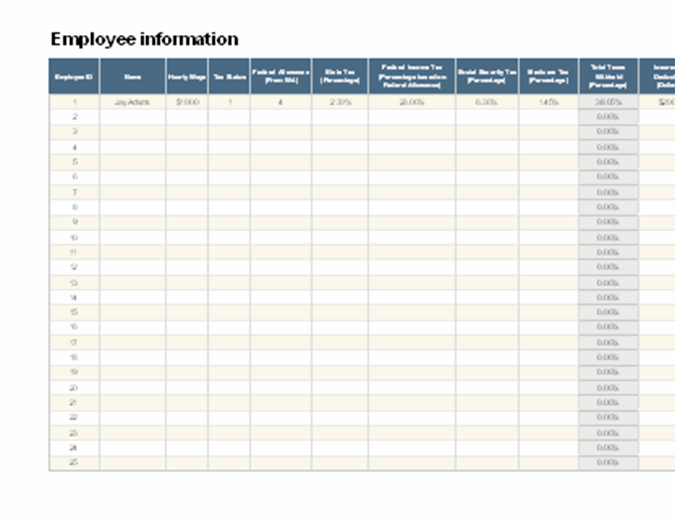

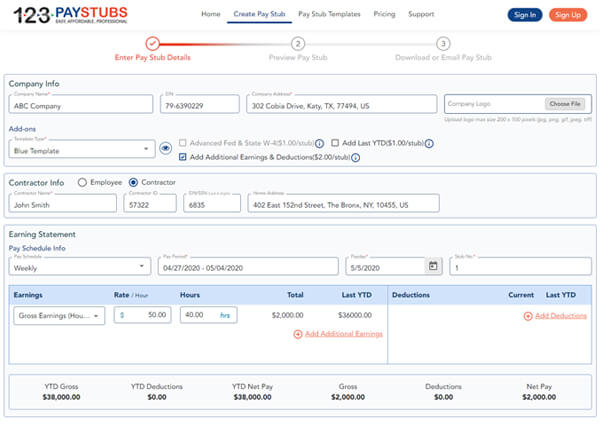

Paycheck Manager is designed to make these tasks simple With the online paycheck calculator software, you can Calculate paychecks and prepare payroll any time; Paycheck Manager Blog Online Payroll Tax Calculator Software Register Today Register to save paychecks and manage payroll, the first 3 months are free!It's Free to Try!

1099 Tax Calculator 21 Quickbooks Payroll

Create Pay Stubs Instantly Generate Check Stubs Form Pros

The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time ZenPayroll, Inc, dba Gusto ("Gusto") does not warrant, promise or guarantee that the information in the Paycheck Calculator is accurate or complete, and Gusto expressly disclaims all liability, loss or risk incurred by employers or employees as a direct or indirect consequence ofLet's dive right in What is a W2?Use this calculator to determine an annual W2 (salary) amount that is approximately equivalent to an annual 1099 (contract) amount If you are a 1099 (Independent Contractor) worker, the IRS requires you to pay 62% of your reported income (up to $128,400) for the employee's share of Social Security tax, and also requires you to pay another 62% of your income (again, up to

How Much Should I Set Aside For Taxes 1099

Hourly Wage Then Log Download Pay Stub Template Word Free Inside Free Pay Stub Template Word Cumed Org Templates Word Free Word Template

Payroll Taxes New W2 & 1099MISC filing deadline for 17 tax season September 27th, 16 Starting in 17 for tax year 16, businesses are required to file W2 and 1099MISC byIncome Tax Calculator Knowing how much you need to save for selfemployment taxes shouldn't be rocket science Our calculator preserves sanity, saves time, and destresses selfemployment taxes in exchange for your emailSalary paycheck calculator guide Although our salary paycheck calculator does much of the heavy lifting, it may be helpful to take a closer look at a few of the calculations that are essential to payroll How to calculate net income Determine taxable income by deducting any pretax contributions to benefits;

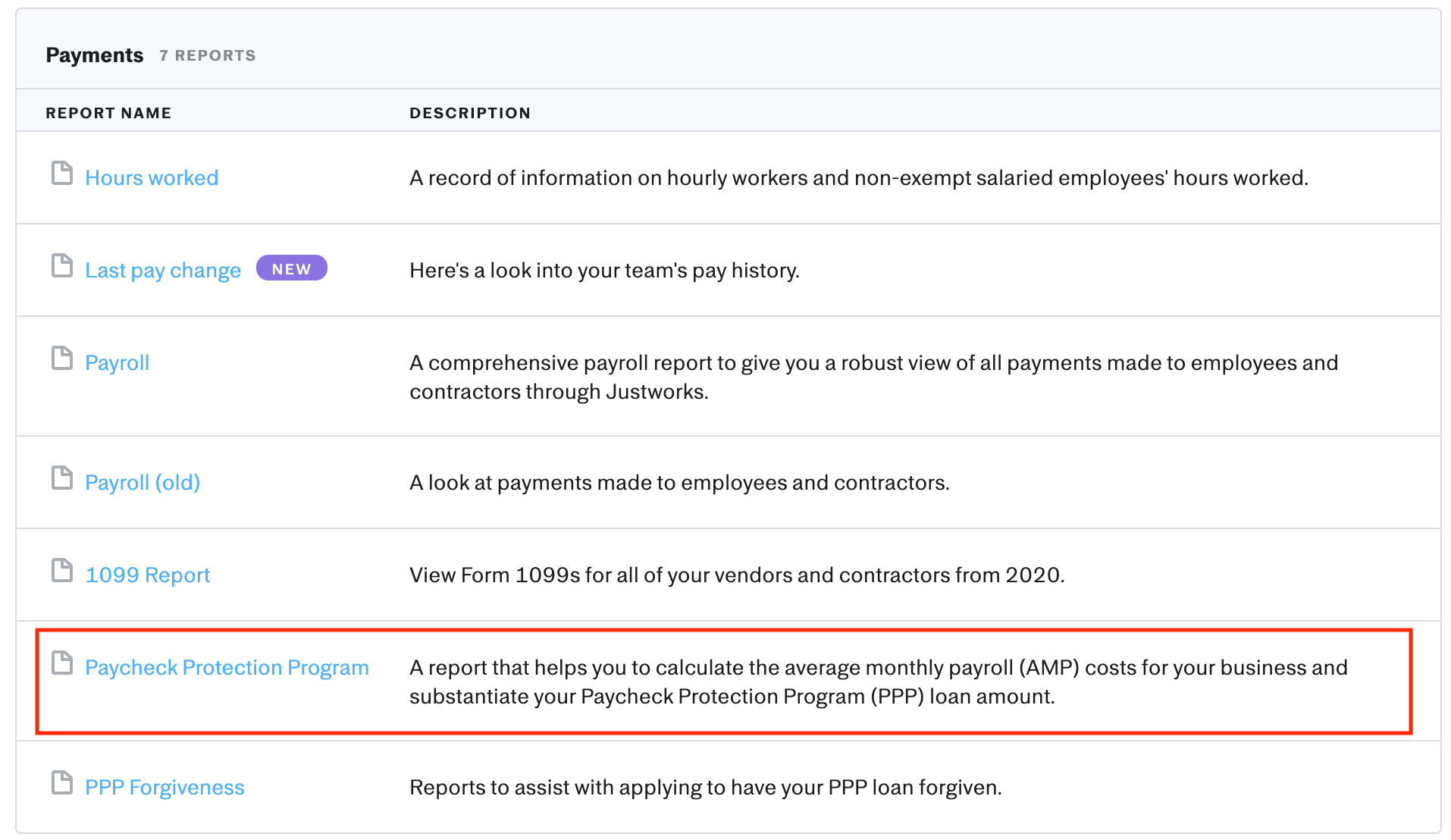

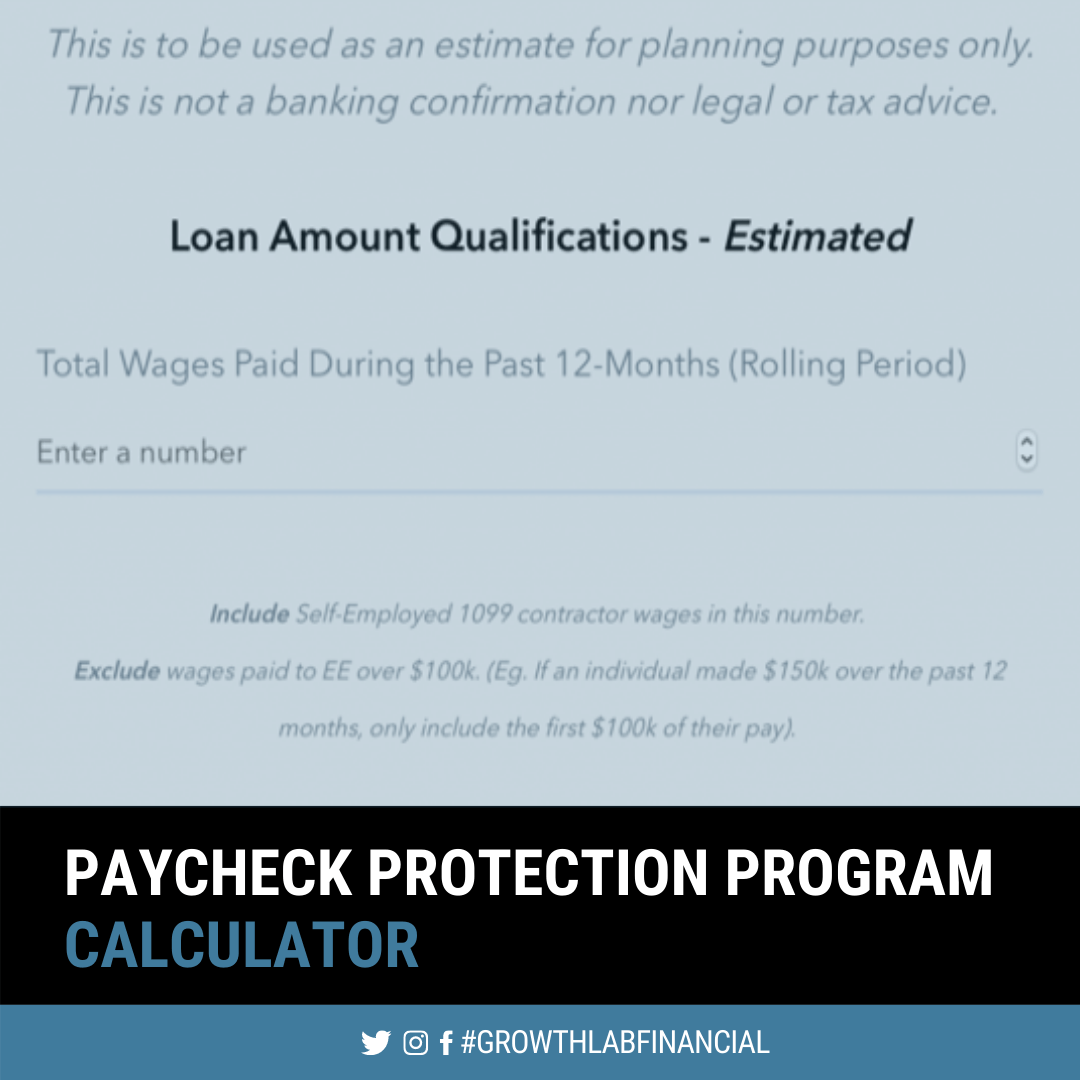

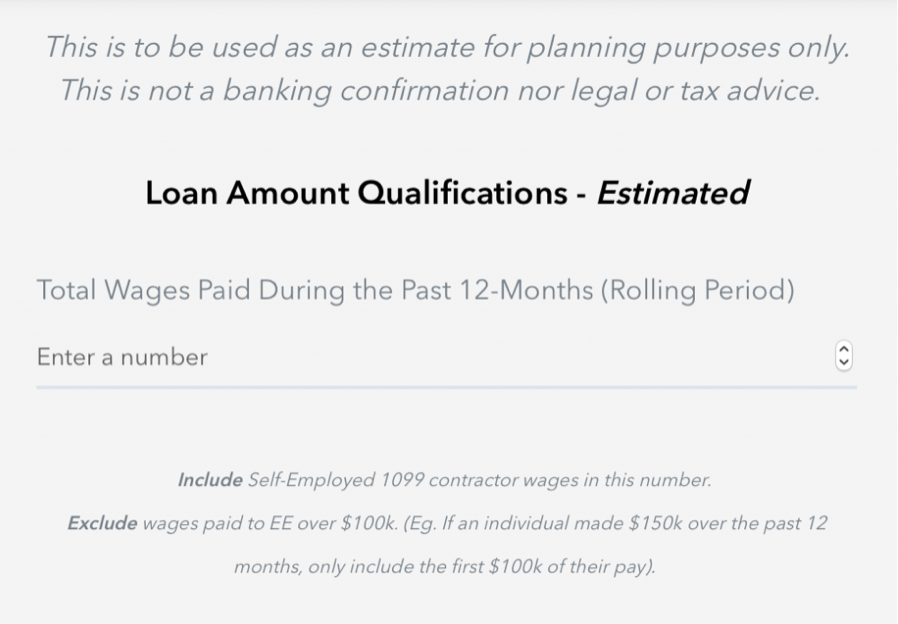

How To Calculate Your Ppp Loan Amount Bluevine

Paystub Generator Us Paycheck Stubs 123paystubs Apps On Google Play

Paycheck Calculator is one of the best available online services that are greatly beneficial to corporate as well as individuals who are selfemployed or own a small businessThey provide proficiency in handling check stubs, thus not requiring users to depend on any third person for carrying out the most important task on behalf of any person or companyYes, 1099 employees are eligible for the Paycheck Protection Program In fact, according to PPP rules, businesses are supposed to leave 1099 Calculate Create and Print Employee Pay Stub PayCheck Stubs IRS W2 and 1099 Forms Fast With Our Free and Easy To Use Online Payroll Software Print out IRS and SSA approved forms Online Easily create proof of employment, proof of income, verification of employment, form w2, tax 1099, 1099 instructions, 1099 filing, 1099 income, irs w2, i 9 employment verification,

How To Calculate Taxable Wages A 21 Guide The Blueprint

1099 To W2 Salary Calculator Jobs Ecityworks

Illinois Salary Paycheck Calculator Change state Calculate your Illinois net pay or take home pay by entering your perperiod or annual salary along with the pertinent federal, state, and local W4 information into this free Illinois paycheck calculator See FAQs below State & DateAn employer can use the calculator to compute and prepare paychecks An employee can use the calculator to compare net pay with different number ofGeorgia Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local W4 information This Georgia hourly paycheck calculator is perfect for those who are paid on an hourly basis See FAQs below

Arkansas Paycheck Calculator Smartasset

Free Tip Tax Calculator

Print pay stub with detailed summary or paychecks on blank check stocks;This calculator provides an estimate of the SelfEmployment tax (Social Security and Medicare), and does not include income tax on the profits that your business made and any other income For a more robust calculation, please use QuickBooks SelfEmployed 18 SelfEmployed Tax Calculator SelfEmployment Tax $000* $000 Medicare Tax 29%Use this SelfEmployment Tax Calculator to estimate your tax bill or refund This tool uses the latest information provided by the IRS including annual changes and those due to tax reform Gather your tax documents including 1099s, business receipts, bank records, invoice payments, and related documents to fill in the drop down sections

Fha Loan With 1099 Income Fha Lenders

How Much In Taxes Do You Really Pay On 1099 Income Taxhub

Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary, or to learn more about income tax in the US Can be used by salary earners, selfemployed, or independent contractors Also explore hundreds of other calculators addressing topics such as tax, finance, math, fitness, health, and many moreThis free paycheck calculator makes it easy for you to calculate pay for all your workers, including hourly wage earners and salaried employees Here's a stepbystep guide to walk you through the tool 1 Fill in the employee's details This includes just two items their name and theA W2 is simply a tax form where businesses report the

Form 1099 Nec For Nonemployee Compensation H R Block

Esmart Payroll Tax Software Filing Efile Form 1099 Misc 1099c W2 W2c 940 941 De9c E File Corrections

The Vendor & 1099 Payroll Center inside Payroll Mate Payroll Software Pay 1099 contractors, 1099 employees, utility companies, tax agencies, suppliers and any other type of payee or vendor Print nonemployee (vendor / contractor) checks, track different types of 1099 payments, manage vendor notes and contact information, view historical transactions, generate reports and printHourly Paycheck Calculator Enter up to six different hourly rates to estimate aftertax wages for hourly employees Gross Pay Calculator Plug in the amount of money you'd like to take home each pay period and this calculator will tell you what your beforetax earnings need to be 401(k) Planner Estimate the future value of retirement savings based on the interest rate, contribution amount,Paycheck Calculator, Payroll Tax Software, W2 & 1099 Management and Efile Services PaycheckManager – Free paycheck, payroll tax calculator, print paychecks & pay stubs Innovative, flexible, patented online payroll management software designed specifically for

3

Free Net To Gross Paycheck Calculator

Be reminded of pending payroll deposits or reports; You can use this calculator to estimate your 1099 income by week, month, quarter, or year by configuring how much and how often you plan to work It's easy to use— and totally free Try Our SelfEmployed Taxes Calculator Expense 21 Entertaining clients No longer deductible No longer deductible Businessrelated meals 50% deductible 50% deductible OfficeOur 1099MISC generator is the simplest and the most advanced 1099MISC generator tool you will find online In less than 2 minutes, you can create a 1099MISC form, automatically filled with correct calculations and ready to be sent to your employees Providing your company information, as well as the employee information and wage details is

Paycheck Protection Program Report Justworks Help Center

Free Self Employed Tax Calculator View Your Potential Tax Obligation Instantly Hurdlr

Either way, a 1099 vs W2 calculator could help you This post will cover exactly what a 1099 and W2 are and what the pros and cons of each one are On top of that, there will be instructions on how you can get your hands on your very own dynamic 1099 and W2 calculator!Calculating your paychecks is tough to do (without a paycheck calculator) because your employer withholds multiple taxes from your pay The calculations are even tougher in a state like Ohio, where there are state and often local income taxes on top of the federal tax withholding First of all, no matter what state you live in, your employer withholds 62% of your earnings for SocialCalculate 941, 940, etc and export paycheck details Calculate tax deposits, including employer's liabilities View & edit paychecks and payroll summary Manage multiple companies in one account See Demo;

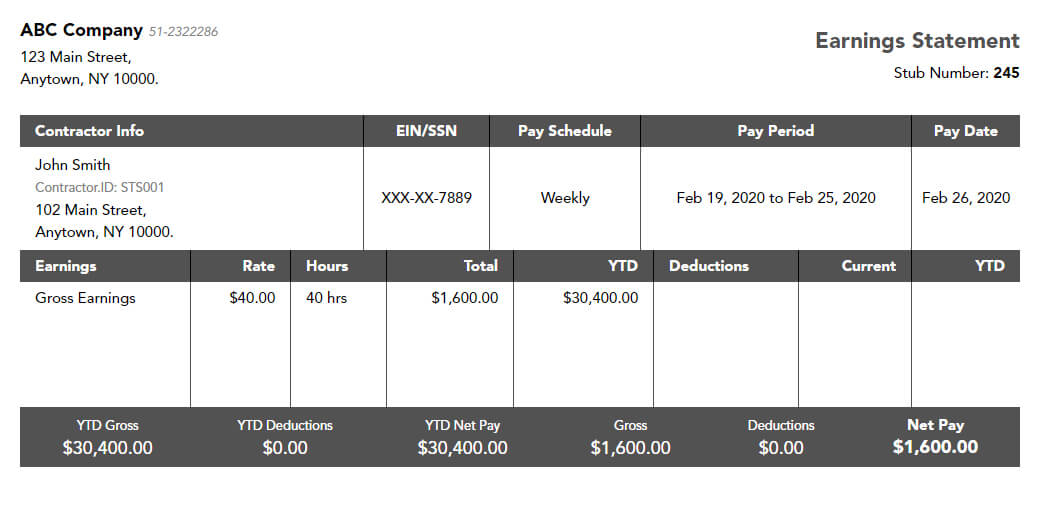

Independent Contractor Paystub 1099 Pay Stub For Contractors

Tax Calculator And Refund Estimator 21 Turbotax Official

Calculate Create and Print Employee Pay Stub PayCheck Stubs IRS W2 and 1099 Forms Fast With Our Free and Easy To Use Online Payroll Software Print out IRS and SSA approved forms Online Easily create proof of employment, proof of income, verification of employment, form w2, tax 1099, 1099 instructions, 1099 filing, 1099 income, irs w2, i 9 employment verification,Withhold all applicable taxes (federal, state and local) Deduct any postThe system enables users to set up overtime, commission, bonus or other earning items with total flexibility Users can also add POP, 401K deduction or other local deductions as needed

W 2 1099 Here S What You Need To Know About Your Employment Status Nailpro

1099 Taxes Calculator Estimate Your Self Employment Taxes

Paycheck Calculator Use our Free Paycheck Calculator spreadsheet to estimate the effect of deductions, withholdings, federal tax, and allowances on your net takehome pay Unlike most online paycheck calculators, using our spreadsheet will allow you to save your results, see how the calculations are done, and even customize it Salary Paycheck Calculator provides all the essential payroll details that must be present on it to be considered valid Firms can even have their logo, company name, and other contact information that can be used for verifications if desired However, you cannot consider the paystub as a legal documentPublic employees, exempt employees paycheck calculation;

How Does A Nanny File Taxes As An Independent Contractor

What Is A 1099 Form And How Does It Work Ramseysolutions Com

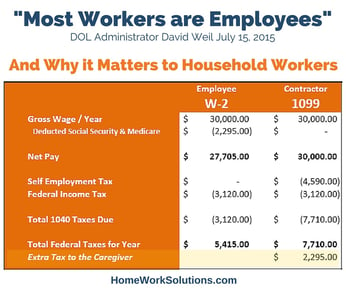

The calculator below will help you compare the most relevant parts of W2 vs 1099 by looking at how the two options affect your income and tax situation, but it's important to note that this is not an exact calculation of your taxes because many other factors outside the scope of this comparison can affect your tax situationAnd print payment vouchers and reports With Paycheck Manager, you have full control over your payroll! Calculate your selfemployment 1099 taxes for free with this online calculator from Bonsai Updated for the 21 tax season to ensure accurate results

Free Tax Calculator Tax Return Estimator Liberty Tax

Llc Tax Calculator Definitive Small Business Tax Estimator

This varied tax distribution poses a problem for a lot of paycheck calculator software Though your program might work in one state, it may be useless in another Not with Advanced Micro Solutions (AMS) Our software provides a paycheck tax calculator that works in all fifty states, the District of Columbia, Don't waste money on a subpar software solution Try our product today W2 1099WwwPaycheckManagercom – easiest online paycheck calculation and payroll management tool wwwSimplePayrollcom – full service payroll online We file payroll reports and make payroll tax deposits for you www1099managercom – for users to prepare, search, edit, print, reprint and efile 1099miscs and corrections It is most beneficialEstimate your paycheck withholding with TurboTax's free W4 Withholding Calculator Updated for your 21 taxes, simply enter your tax information and adjust your withholding to see how it affects your tax refund and your takehome pay on each paycheck The easiest way to figure out how to maximize your tax refund or takehome pay

17 Paycheck Tax Calculator Free To Edit Download Print Cocodoc

/how-much-do-i-budget-for-taxes-as-a-freelancer-453676_V1-e59e69ce6941454cb1025178eab3574d.png)

How Much Should You Budget For Taxes As A Freelancer

Independent Contractor Paystub 1099 Pay Stub For Contractors

Employee Payroll Calculator

/how-to-calculate-your-unemployment-benefits-2064179-v2-5bb27c7646e0fb0026d9374f.png)

How To Calculate Your Unemployment Benefits

Paycheck Protection Program Calculator

Adp Paystub Generator Fill Online Printable Fillable Blank Pdffiller

Paycheck Manager Posts Facebook

How To Calculate Withholding Tax As An Employer Or Employee Ams Payroll

Free Online Paystub Generator Generate Pay Stubs Instantly

Self Employed Taxes How Much To Set Aside 1099 Misc Atax

1099 To W2 Salary Calculator Jobs Ecityworks

Free Tax Calculator Tax Return Estimator Liberty Tax

Free Paycheck Calculator Salary Pay Check Calculator In Usa

Paid Family And Medical Leave Exemption Requests Registration Contributions And Payments Mass Gov

Paycheck Protection Program Calculator

What S The Difference Between W 2 1099 And Corp To Corp Workers

Start The Paycheck Calculator And W 4 Form Creator In 22

Processing The Final Paycheck For A Deceased Employee Checkmate Payroll

Tax Information

Doordash Tax Calculator 21 What Will I Owe How Bad Will It Hurt

Free Tax Calculator Tax Return Estimator Liberty Tax

New W 2 1099 Misc Filing Deadline For 17 Tax Season Paycheck Manager

Walk Through Filing Taxes As An Independent Contractor

Free Paycheck Calculator Salary Pay Check Calculator In Usa

Doordash 1099 Taxes And Write Offs Stride Blog

Online Check Stub Calculator With Year To Date Information Stub Creator

Paycheck Calculator Apo Bookkeeping

Payrollguru Mobile Payroll Applications And Payroll Services

1099 Taxes Calculator Estimate Your Self Employment Taxes

Advice For Small Business Payroll How To Correct A Previously Issued Form 1099 Misc Paycheck Manager

17 Paycheck Tax Calculator Free To Edit Download Print Cocodoc

Free Check Stub Maker With Calculator Easy Paystub Maker Online In Usa

Paycheck Calculator Take Home Pay Calculator

Independent Contractor Paystub 1099 Pay Stub For Contractors

Can I Use Online Pay Stubs To File Taxes Stub Creator

Esmart Paycheck Calculator Free Payroll Tax Calculator 21

Small Business Payroll Try For Free Paycheckcity

Employer Payroll Tax Calculator Gusto

Pay Stub Generator Free Printable Pay Stub Template Formswift

Independent Contractor Paystub 1099 Pay Stub For Contractors

/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Tax Guide For Independent Contractors

Quarterly Tax Calculator Calculate Estimated Taxes

1099 Vs Salary Calculator Jobs Ecityworks

Estimated Tax Payments For Independent Contractors A Complete Guide

Independent Contractor Paystub 1099 Pay Stub For Contractors

Start The Paycheck Calculator And W 4 Form Creator In 22

How To Make A 1099 Pay Stub For The Self Employed The Daily Iowan

W 2 1099 Filer Software Net Pr Calculator

Free Paycheck Calculator Salary Pay Check Calculator In Usa

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

How To Provide Paycheck Proof When You Re Self Employed Az Big Media

Free Pay Stub Templates Smartsheet

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

3

1

15 Paycheck Calculator Free To Edit Download Print Cocodoc

Deadlines For W2 W3 And 1099 Misc Corrections For The 17 Tax Season Paycheck Manager

2

1099 Tax Rate For 21 And 5 More 1099 Worker Tax Tips Stride Blog

Free Check Stub Maker With Calculator Easy Paystub Maker Online In Usa

1099 To W2 Salary Calculator Jobs Ecityworks

New Tax Law Take Home Pay Calculator For 75 000 Salary

Free Pay Stub Templates Smartsheet

29 Free Payroll Templates Payroll Template Payroll Checks Statement Template

/payroll-taxes-3193126-FINAL-ef94c8b30eda48fdbde6ab58d9a30d49.png)

Payroll Taxes And Employer Responsibilities

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

1

How Much Should I Save For Taxes Grubhub Doordash Uber Eats

Dad S Home Health Aide Is An Independent Contractor A Case Study

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

Paystub Generator For Self Employed Fill Online Printable Fillable Blank Pdffiller

1099 Tax Calculator 21 Quickbooks Payroll

Self Employment Tax Calculator Estimate Your 1099 Taxes

0 件のコメント:

コメントを投稿