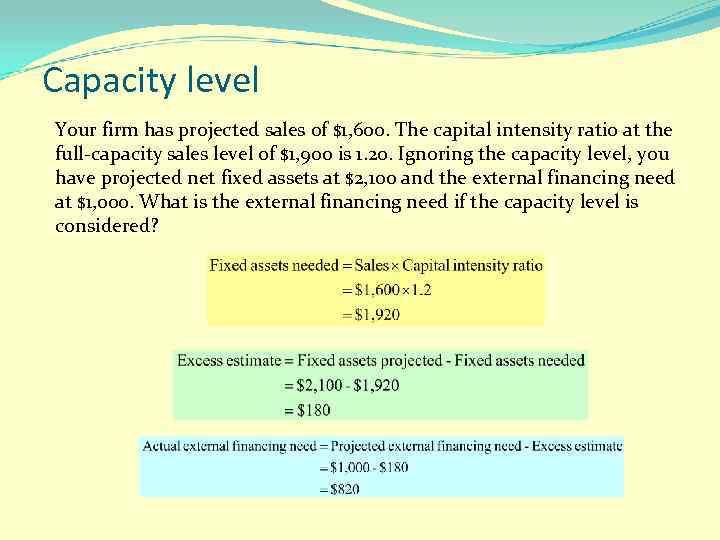

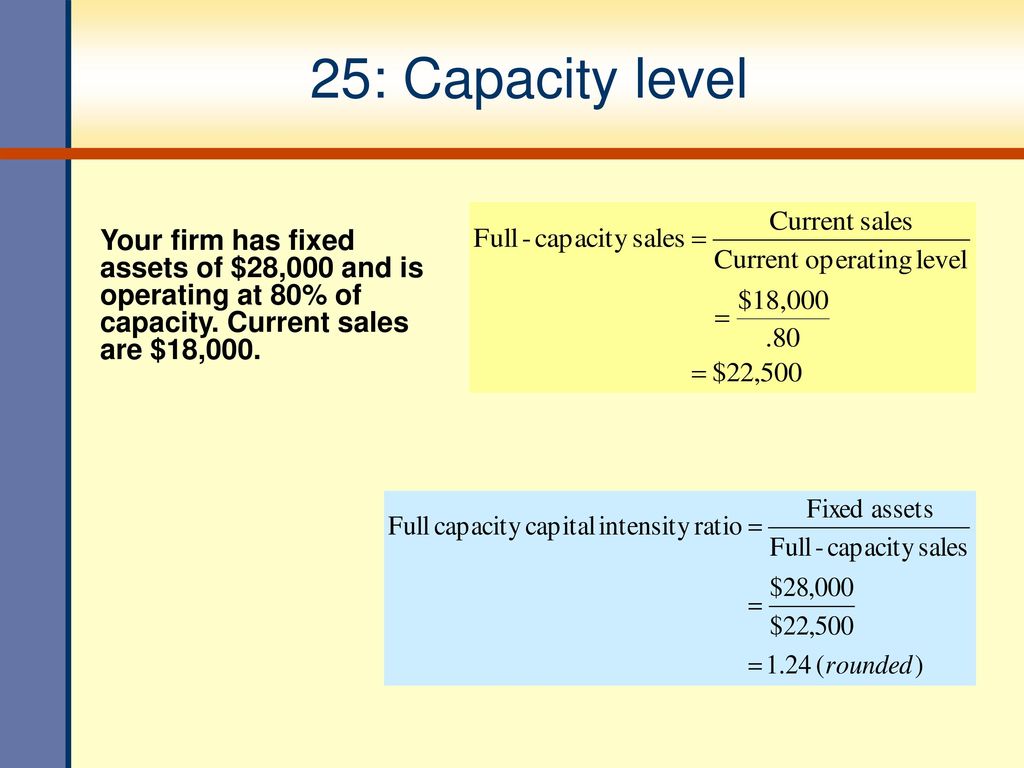

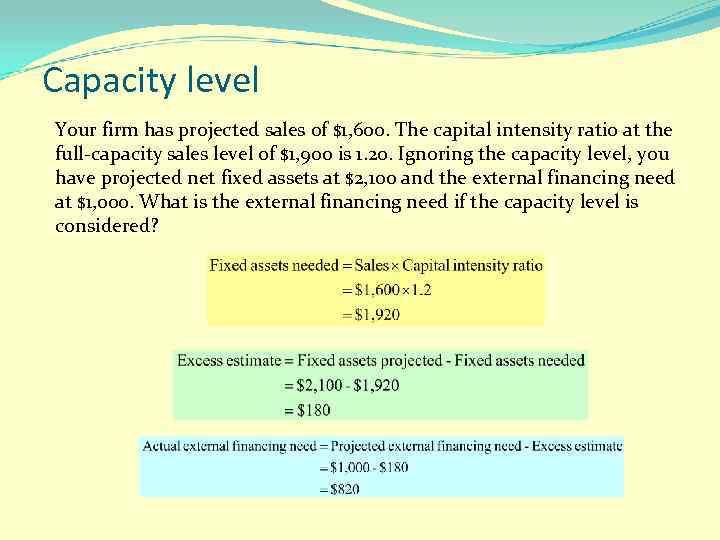

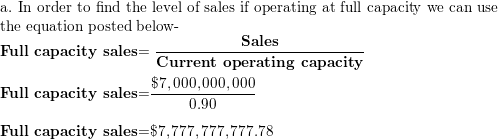

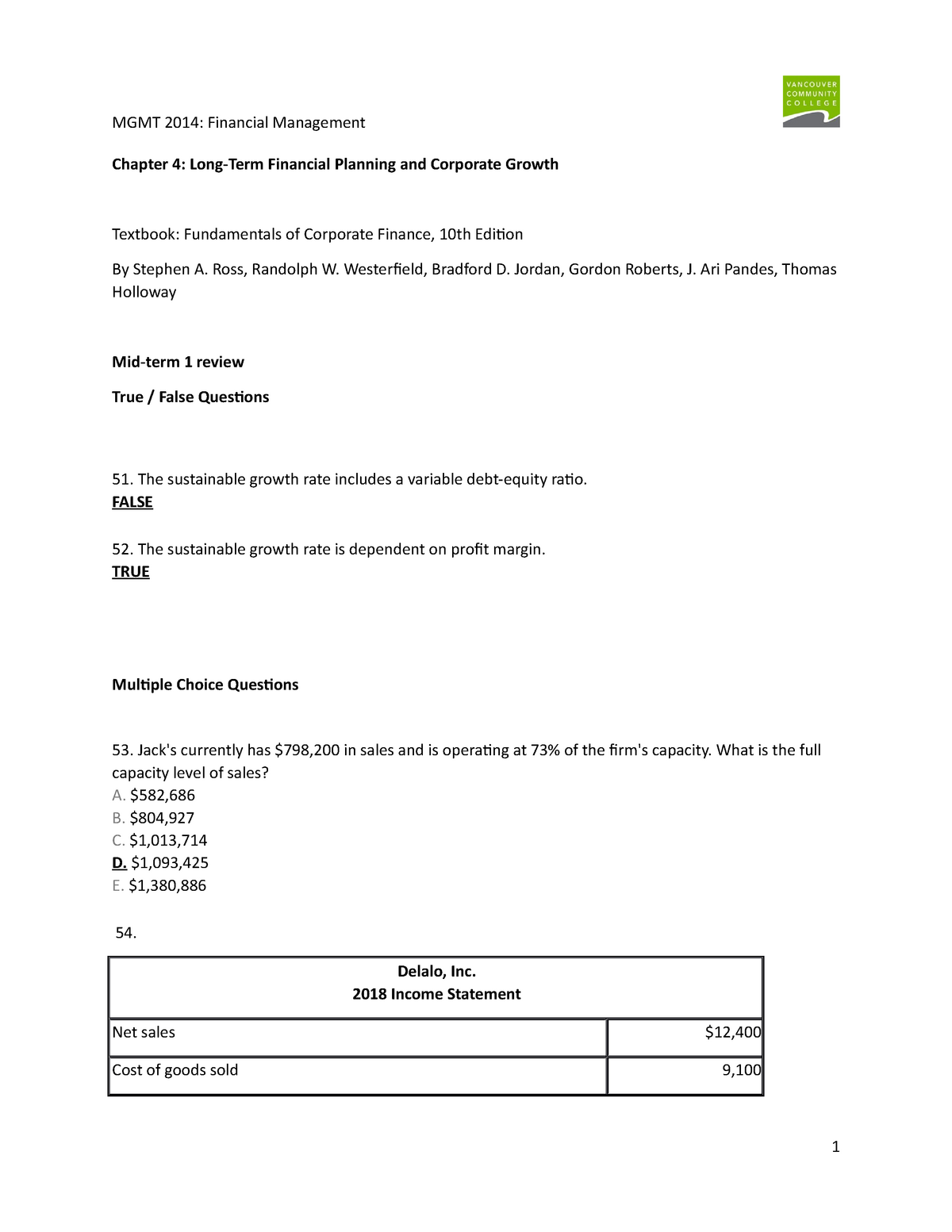

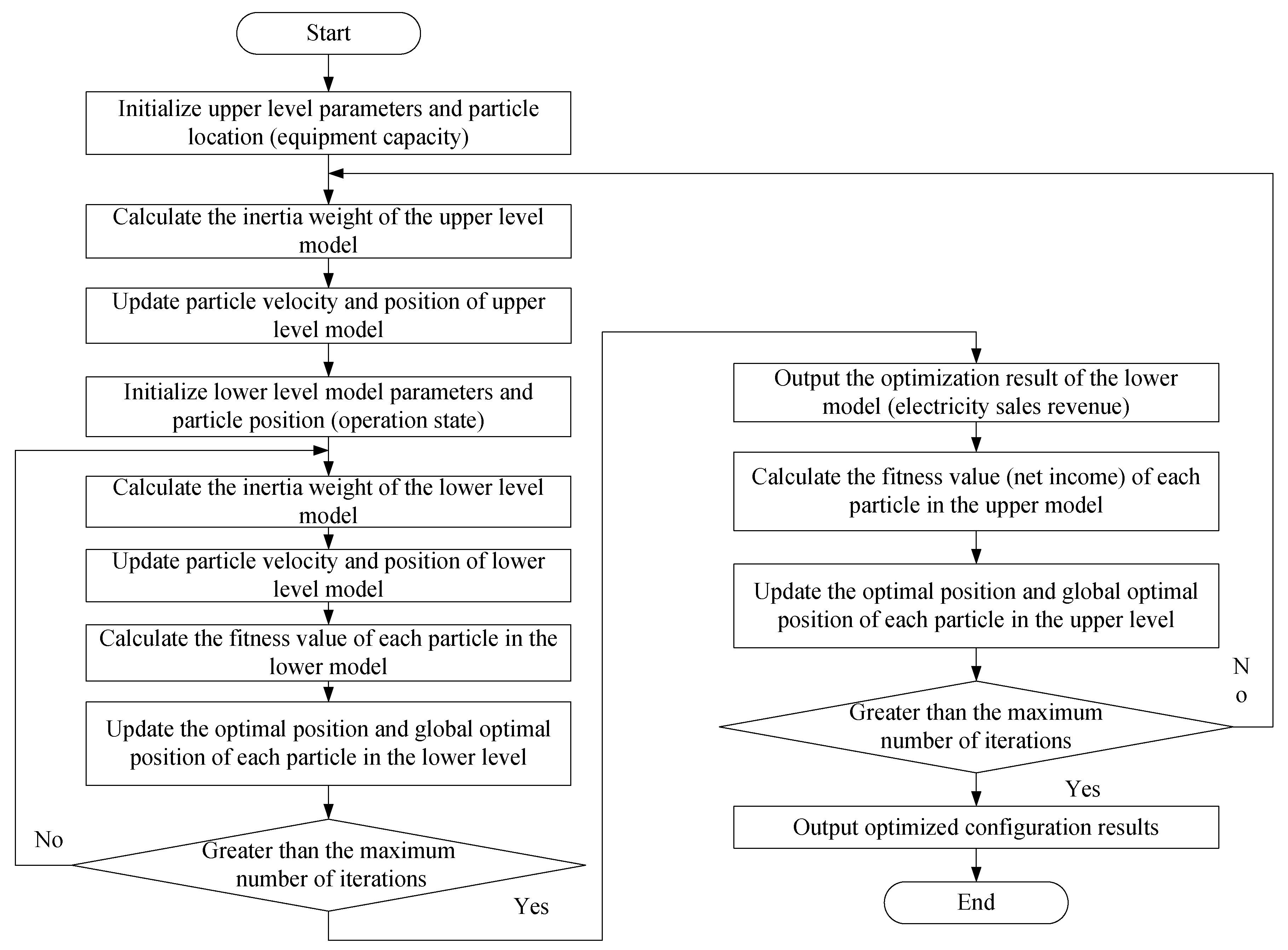

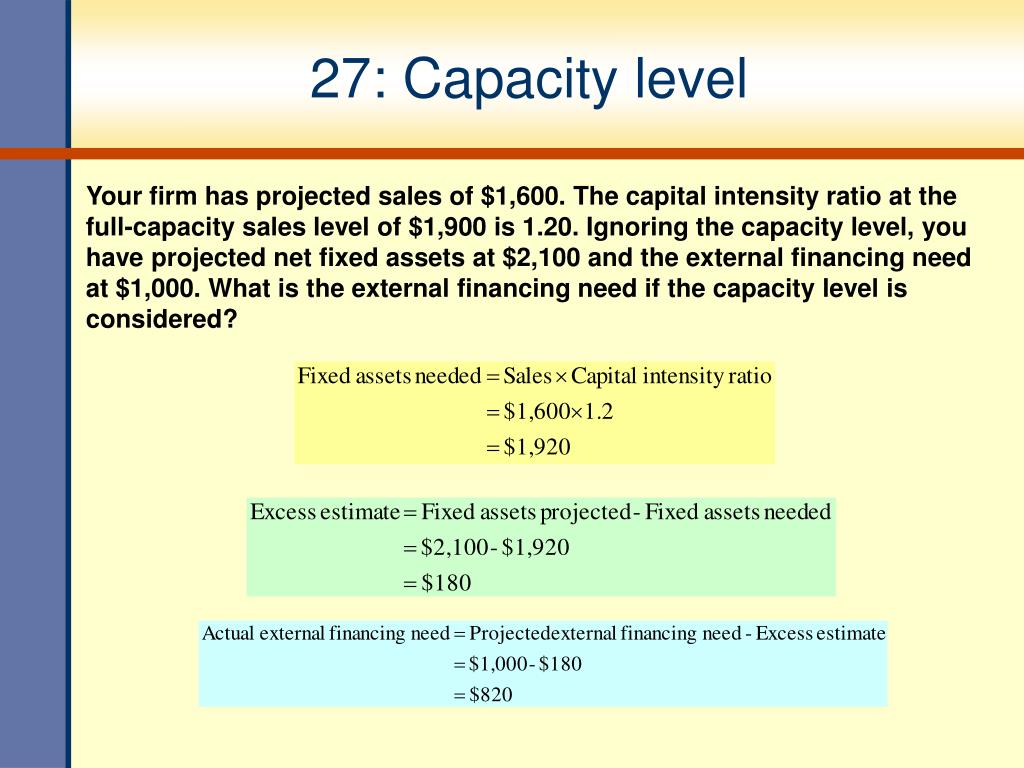

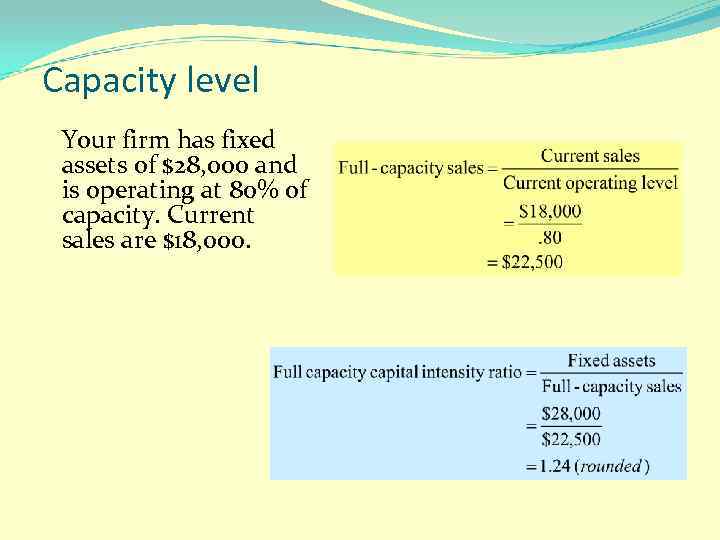

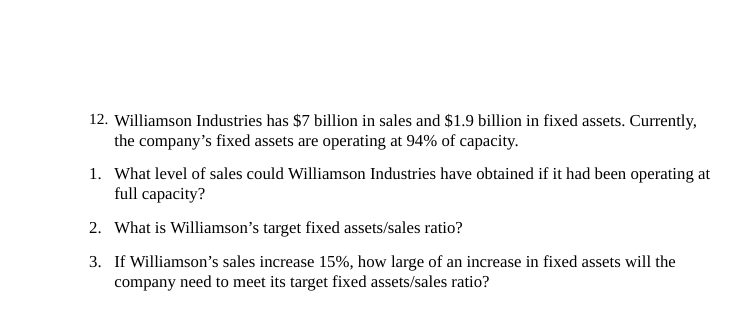

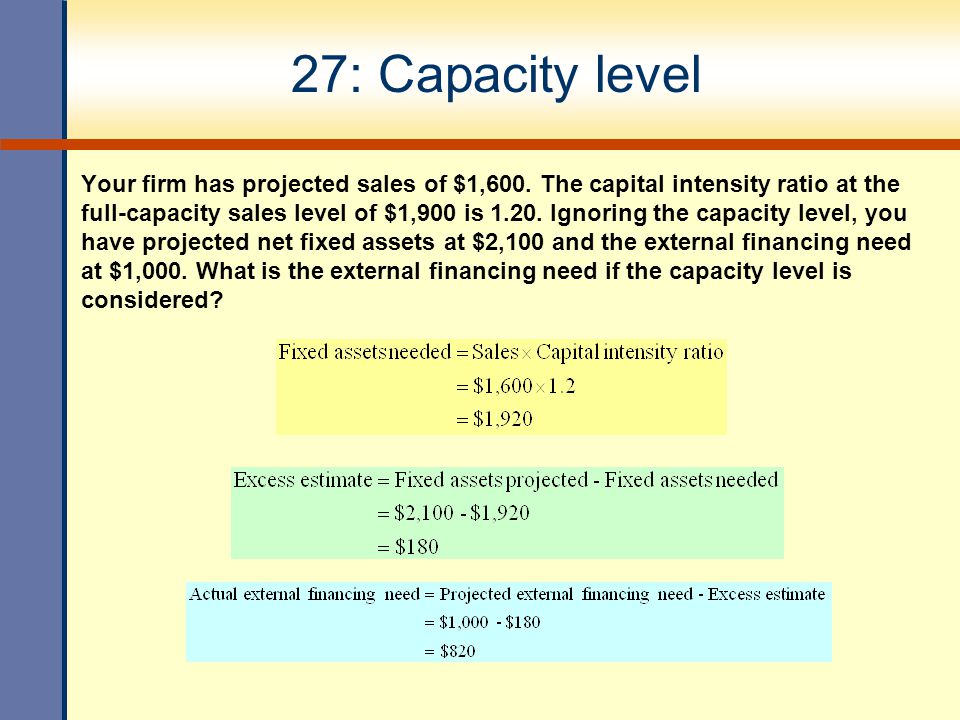

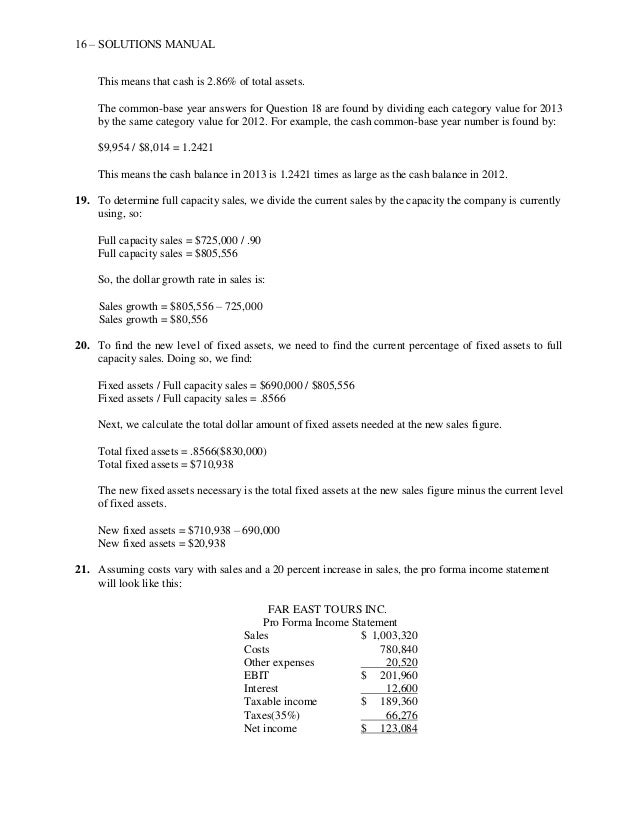

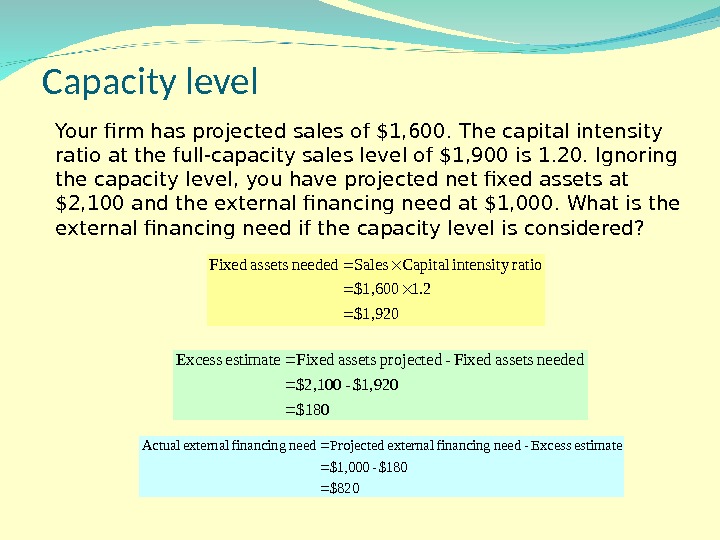

Full capacity sales are equal to current sales divided by the capacity utilization At 60 percent of capacity $4,250 =60 ×Full capacity sales $7,0 =Full capacity sales With a sales level of $4,675, no net new fixed assets will be needed, so our earlier estimate is too high We estimated an increase in fixed assets of $2,4 2,0 = $2B What is Walter's Target fixed assets/Sales ratio?Full capacity sales = Actual sales Percentage of capacity at which fixed Assets were operated Next, management would calculate the firm's target fixed assets ratio as follows Total fixed as Sales Actual fixed assets Pull capacity sales Finally, management would use the target fixed assets ratio with the projected sales to calculate the firm's required level

Long Term Financial Planning And Growth Ch 4

Full capacity level of sales

Full capacity level of sales-Full capacity sales refers to the optimal sales amount, up to which situation a firm does not need the help of any external financing for the assets In this case, S Mfg Inc is currently operating at 92 percent of fixed asset capacity and its current sales are $690,000 Capacity costs are expenditures made to provide a certain volume of goods or services to customers For example, a company may operate a production line on three shifts in order to provide goods to its customers in a timely manner Each successive shift constitutes an incremental capacity cost

5nplus Com

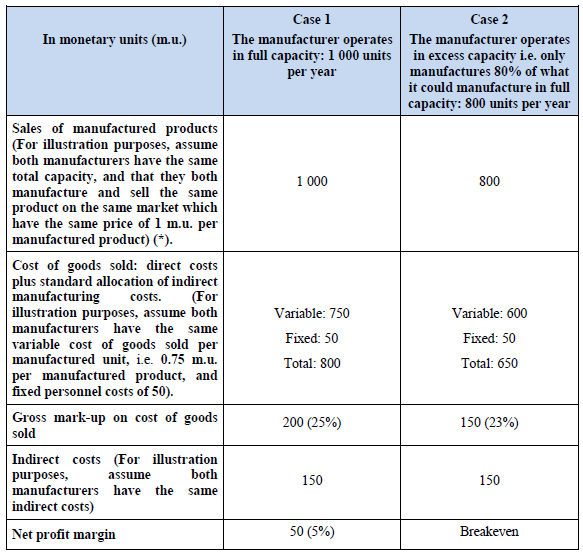

Moltissimi esempi di frasi con "capacity and sales" – Dizionario italianoinglese e motore di ricerca per milioni di traduzioni in italianoBased on its existing sales, what is the formula for calculating the fullcapacity sales of a firm? Fullcapacity sales are equal to current sales divided by the capacity utilization At 60 percent of capacity $4,250 =60 ×Fullcapacity sales $7,0 =Fullcapacity sales With a sales level of $4,675, no net new fixed assets will be needed, so our earlier estimate is too high We estimated an increase in fixed assets of $2,42,0 = $2

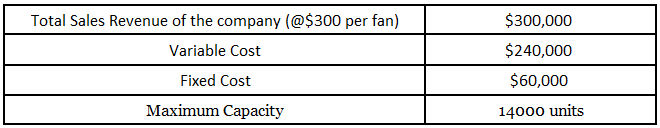

Muchos ejemplos de oraciones traducidas contienen "capacity of sales" – Diccionario españolinglés y buscador de traducciones en español For sales management, a key element that gets measured is sales capacity Your sales capacity is the answer you obtain from the following equation the number of sales reps you have on the team, multiplied by the number of weekly hours that your team works per year, multiplied by the percentage of time spent selling and finally multiplied by•Actual sales Sales •Capacity information Manufacturing •Management targets –Produces at or close to full capacity for all of the carrying costs Comparison of Chase versus Level Strategy Chase Demand Level Capacity Level of labor skill required Low High Job discretion Low High Compensation rate Low High Training required per

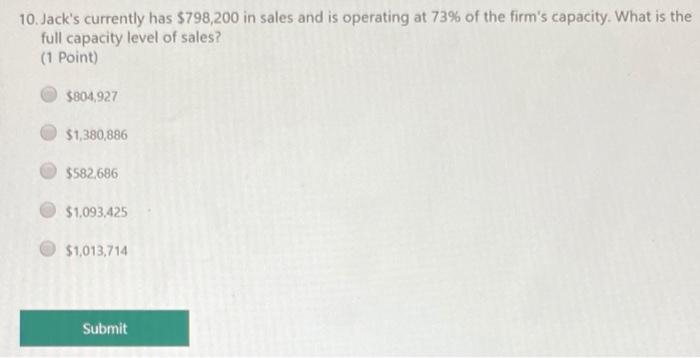

Fullcapacity sales = Existing sales level ÃPercent of capacity used to generate existing sales levelb ?146If a firm is at fullcapacity sales, it means the firm is at the maximum level of production possible without increasing A net working capital B cost of goods sold C inventory D fixed assets E the debt ratio 147The internal growth rate increases when the A retention ratio decreases B dividend payout ratio increases C net income decreasesA) Fullcapacity sales = Existing sales level ÷ Percent of capacity used to generate existing sales level B) Fullcapacity sales = Future sales level ÷ (1 Percent of capacity used to generate future sales level) C) Fullcapacity sales = Existing sales level ÷ Percent of capacity used to generate future sales level

Sales Capacity Planning Get The Most Out Of Your Sales Team Espatial

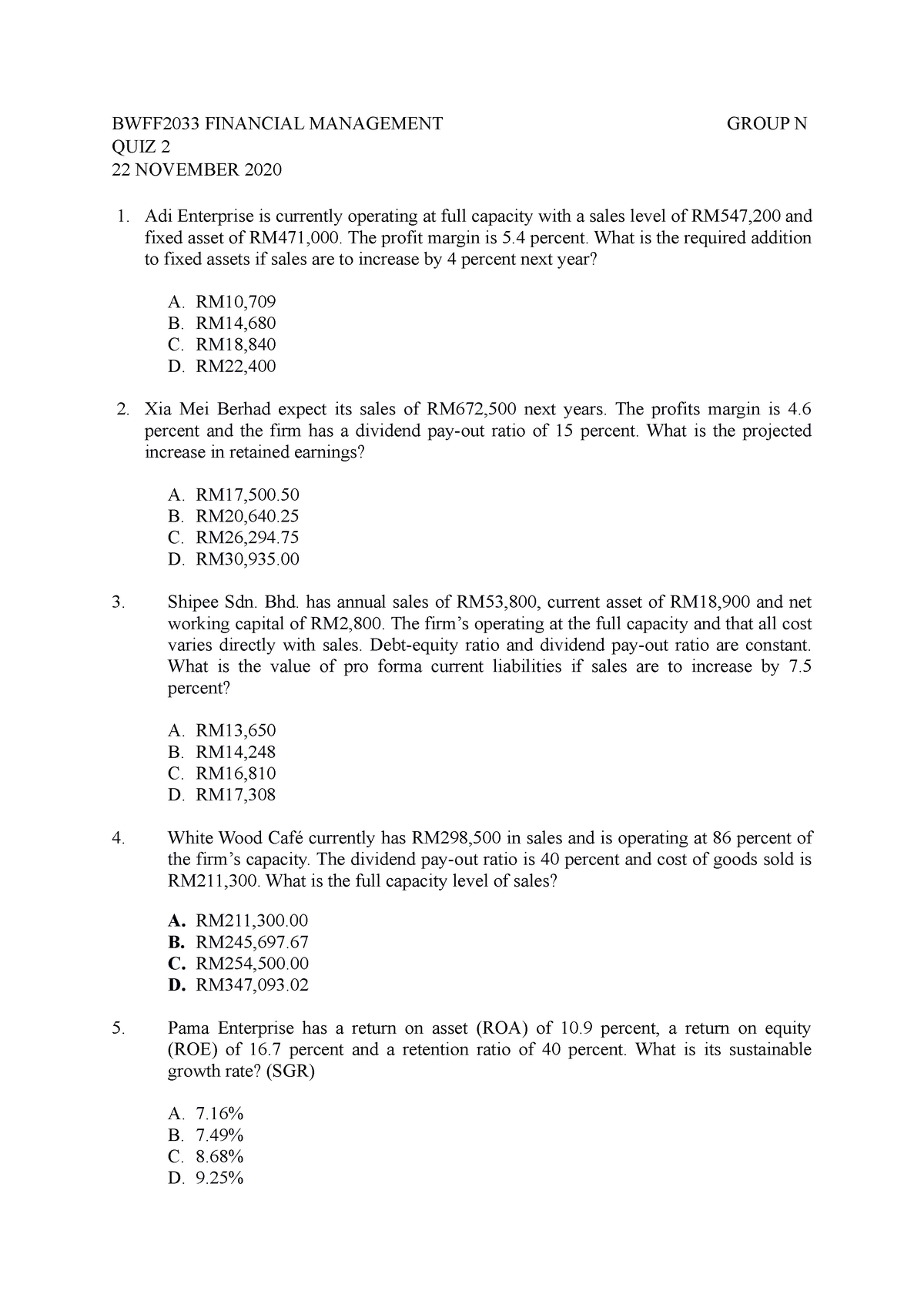

Quiz 2 Quiz Bwff33 Financial Management Group N Quiz 2 22 November Adi Enterprise Is Studocu

Moltissimi esempi di frasi con "capacity sales" – Dizionario italianoinglese e motore di ricerca per milioni di traduzioni in italianoAt its simplest, the formula for traditional Sales Capacity Planning = SR * H * W * CR * ST As an example, a sales team with seven reps, working 45 weeks per year, with a 30% closing rate and a 40% selling time, the formula would be Sales Capacity = SR (7) * H (40) * W (45 weeks / year) * CR (28%) * ST (40%) This results in a total sales capacity of 1081 sales/year for the team The assumption is that each team member makes 215 average sales3 If a firm is operating at full capacity, the firm is a Generating the maximum level of sales given the current level of inventory b Operating 24 hours a day c Operating at the highest possible debtequity ratio d Generating the maximum amount of sales given the available level of cash e Producing the maximum level of sales given the current

Entry Level Sales Resume Examples Template 10 Writing Tips

Cleveland Indians Announce More Fans Allowed In Ballpark For May Games

Fullcapacity sales = $298,900 / 86 = $347, Rural Market's has $878,000 of sales and $913,000 of total assets The firm is operating at 93 percent of capacityWhat is the formula for calculating the fullcapacity sales of a firm? Hence, for a system working at full capacity, it is the average quantity produced in a given time period If your system is working at less than capacity, however, you cannot take the total production quantity For example, if you produced ,000 gizmos per week, but half of the time your people were idling, then you cannot use the ,000

Sales Assessment For Sales Team Capacity Score Selling Sales Training

Lsu Planning For Full Capacity In Tiger Stadium As Season Ticket Sales Top 19 Mark

Capacity is the maximum level of output that a company can sustain to make a product or provide a service Planning for capacity requires management to accept limitations on the production processAt 726 am Reply internal dimension This dimension relates to your current business operationFull capacity sales refers to the optimal sales amount, up to which situation a firm does not need the help of any external financing for the assets In this case, S Mfg Inc is currently operating at 92 percent of fixed asset capacity and its current sales are $690,000

Long Term Financial Planning And Growth Ppt Download

/dotdash_Final_Asset_Turnover_Ratio_Aug_2020-03-c36b34f0f73c4529bbfeaeee335d33d0.jpg)

Asset Turnover Ratio Definition Formula Examples

A)Fullcapacity sales = Existing sales level ÷ Percent of capacity used to generate existing sales level B)Fullcapacity sales = Future sales level ÷ (1 Percent of capacity used to generate existing sales level) C)Fullcapacity sales = Future sales level ÷ Percent of capacity used toPlant Capacity Level Type # 3 Capacity to Make and Sell If the concern is not able to sell the entire quantity produced due to lack of demand, it will not work at full capacity The capacity based on expected sales is, therefore, the capacity required to meet the demand or sales Miller Bros Hardware is operating at full capacity with a sales level of $6,700 and fixed assets of $468,000 The profit margin is 7 percent What is the required addition to fixed assets if sales are to increase by 10 percent?View Solution Miller Bros Hardware is operating at full capacity with a Need your ASSIGNMENT

Capacity Requirements For Delta Synthetic Fibres Assignment

12 2 Mitchell Manufacturing Company Has 1 100 000 000 In Sales And 370 000 000 In Fixed Assets Currently The Compan Homeworklib

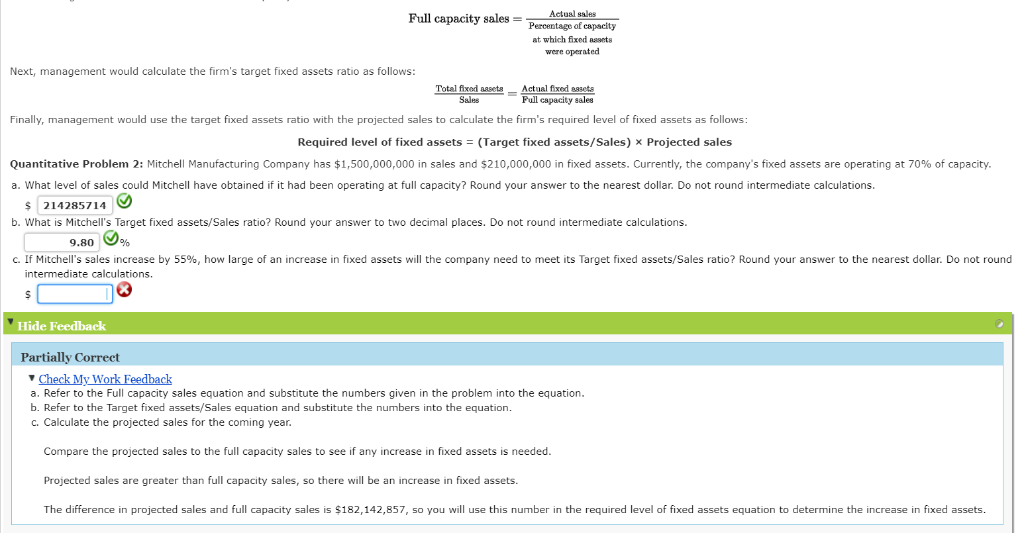

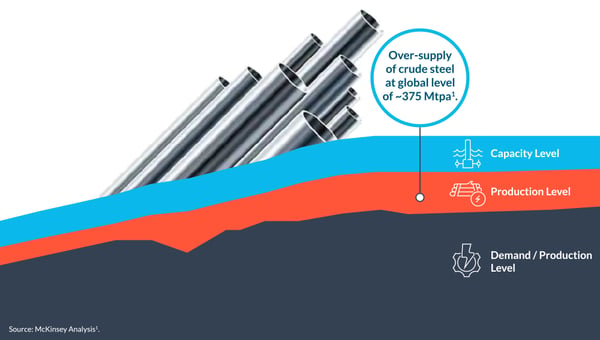

Delta Mfg is currently operating at full capacity The firm has sales of 600 from MGMT 250 at Simon Fraser University Capacity Market Capacity markets or mechanisms could be introduced (if not already in place) to motivate cost–effective supply adequacy (Zhou et al, 15), and the design of system frequency response and reserve products could be tailored to remove barriers to demandside resources, such as may be found in an EPNProjected sales are greater than full capacity sales, so there will be an increase in fixed assets The difference in projected sales and full capacity sales is $1,142,857, so you will use this number in the required level of fixed assets equation to determine the increase in fixed assets

Consumer Electronics Godrej Appliances Sales Reach Pre Covid Level Expect Full Capacity Utilisation By Sep Retail News Et Retail

Solved Break Even Sales Under Present And Proposed Conditions Howard 1 Answer Transtutors

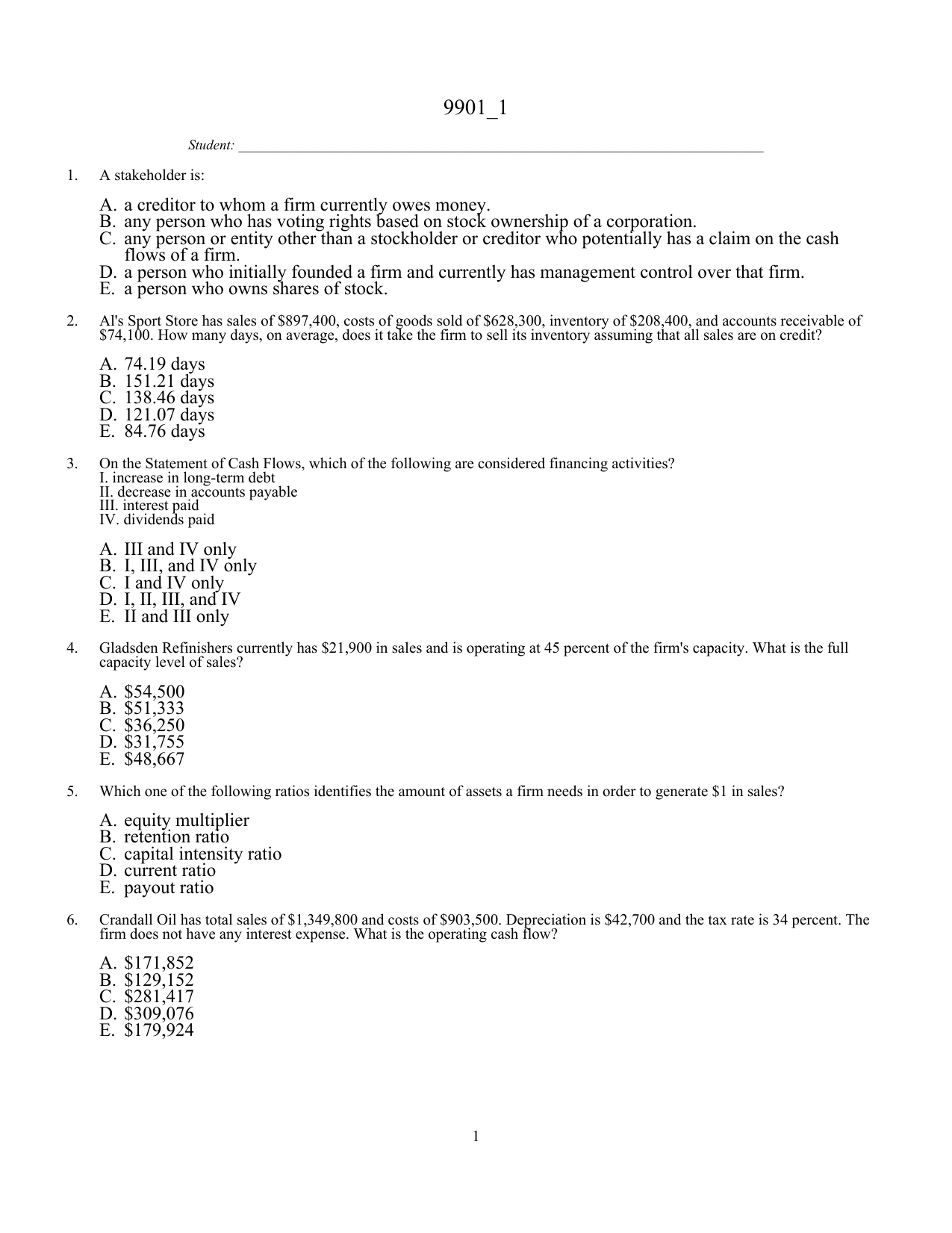

Gladsden Refinishers currently has $21,900 in sales and is operating at 45 percent of the firm's capacity What is the full capacity level of sales?Suppose a firm is working at full capacity and that assets, costs, and all liabilities are tied directly to the level of sales B Raise your dividend payout to accommodate the growth C Because a firm with excess capacity has some room to expand sales without increasing the investment in fixed assets Concepts 68 Concepts 43 A Illegal Activity Capacity The degree to which a particular action is expected to perform Activity capacity refers to an activity's upper threshold of performance based on

9901 1 A Days B Days C Days D Days E Days Pdf Free Download

Godrej Appliances Sales Reach Pre Coronavirus Level Expect Full Capacity Utilisation By September

Full capacity sales are equal to current sales divided by the capacity utilization At 60 percent of capacity $4,250 =60 ×Full capacity sales $7,0 =Full capacity sales With a sales level of $4,675, no net new fixed assets will be needed, so our earlier estimate is too high We estimated an increase in fixed assets of $2,4 2,0 = $2Further detail about this can be seen hereAccordingly, what level of sales can the company have at full capacity? Full Capacity BIBLIOGRAPHY Full capacity refers to the potential output that could be produced with installed equipment within a specified period of time Actual capacity output can vary within two limits (1) an upper limit that refers to the engineering capacity — that is, the level of output that could be produced when the installed equipment is used to its maximum time of

Sales Objectives Examples Pipedrive

Capacity

Normal capacity takes into account the downtime associated with periodic maintenance activities, crewing problems, and so forth When budgeting for the amount of production that can be attained, normal capacity should be used, rather than the theoretical capacity level, since the Capacity Utilization = 50% If all the resources are utilized, then the capacity rate is 100%, and this indicates full capacity It is unlikely that a company achieves 100% rate every time as it can face several hurdles in the production process 85% capacity utilization is considered good for most companiesFullcapacity sales = $878,000 / 93 = $944, Capital intensity ratio = $913,000 / $944, = 97 The most recent financial statements for RPJ Co are shown here

Long Term Financial Planning And Growth Ch 4

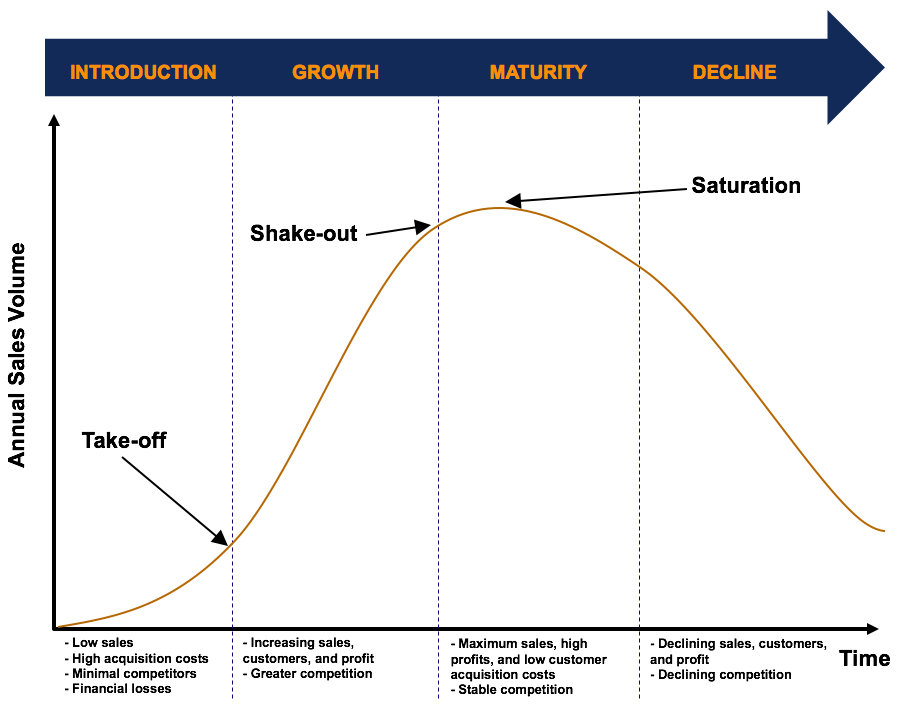

Product Life Cycle Overview Four Stages In The Product Life Cycle

Mitchell Manufacturing Company has $1,0,000,000 in sales and $260,000,000 in fixed assets Currently, the company's fixed assets are operating at 80% of capacityYou saw how knowing your maximum capacity was important to sales as it told you how much you Creating Your Business Plan Made Easy!First, we need to calculate full capacity sales, which is Full capacity sales = $905,000 / 80 Full capacity sales = $1,131,250 The capital intensity ratio at full capacity sales is Capital intensity ratio = Fixed assets / Full capacity sales Capital intensity ratio = $364,000 / $1,131,250 Capital intensity ratio = The fixed assets required at full capacity sales is the capital intensity

Whatcomcounty Us

What Is Sales Capacity Planning

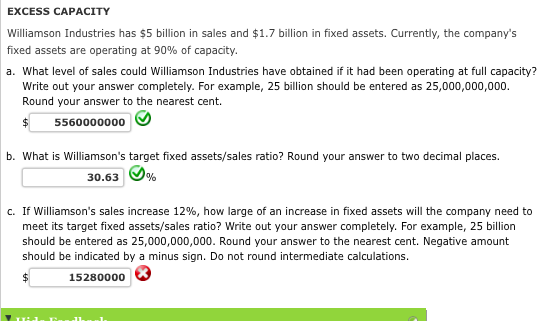

EXCESS CAPACITY Walter Industries has $5 billion in sales and $1 7 billion in fixed assets Currently, the company's fixed assets are operating at 90% of capacity a What level of sales could Walter Industries have obtained if it had been operating at full capacity?This means that Rosengarten needs $162 in fixed assets for every dollar in sales when it reaches full capacity At the projected sales level of $1,250, it needs $1,250 * 162 = $2,025 in fixedA $31,755 B $36,250 C $48,667 D $51,333

Information Sharing For Sales And Operations Planning Contextualized Solutions And Mechanisms Sciencedirect

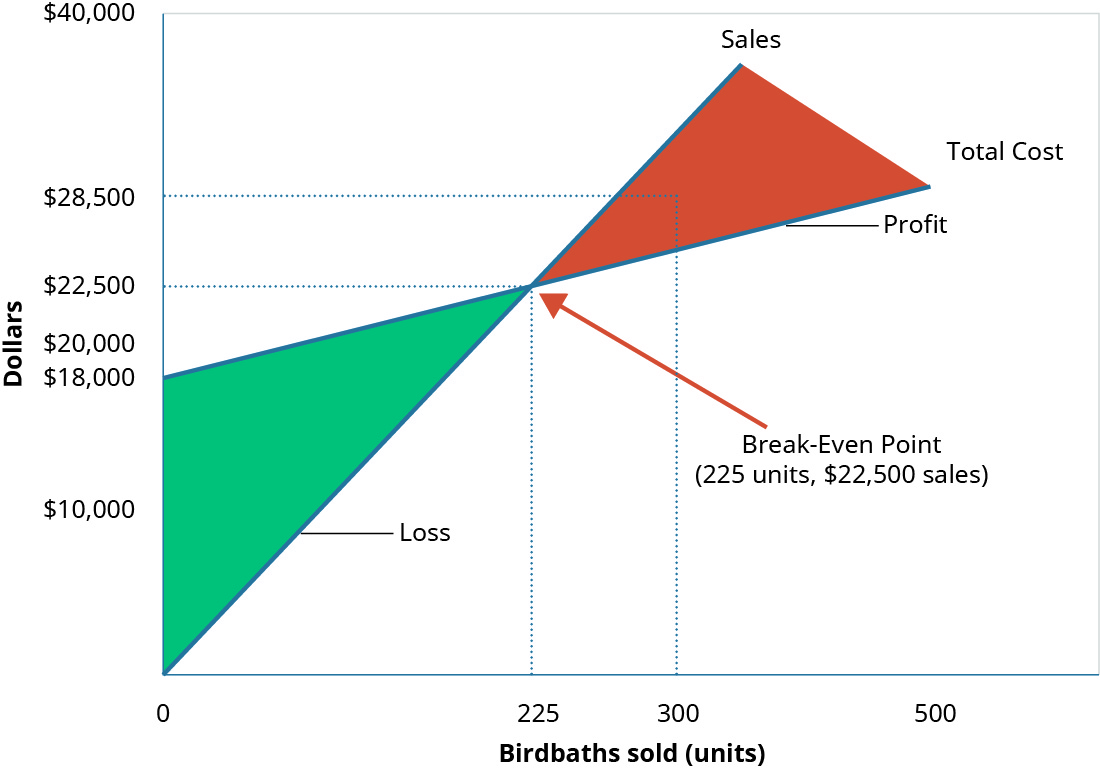

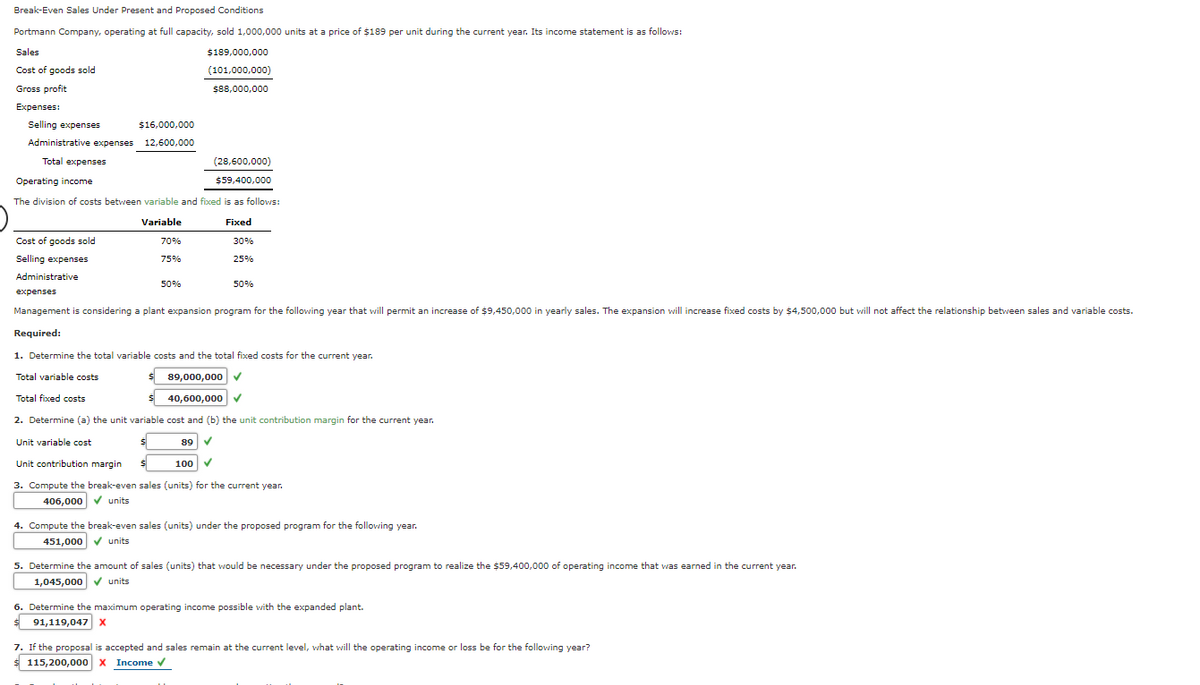

Calculate A Break Even Point In Units And Dollars Principles Of Accounting Volume 2 Managerial Accounting

Traduzioni in contesto per "sales capacity" in ingleseitaliano da Reverso Context Grant funds will be used to increase production and sales capacity選択した画像 full capacity level of sales formula How to calculate sales capacity /03/ In accounting, the margin of safety is calculated by subtracting the breakeven point amount from the actual or budgeted sales and then dividing by sales;Fullcapacity sales = Future sales level Ã(1 Percent of capacity used to generate future sales level)c ?Fullcapacity sales = Existing sales level ÃPercent of capacity used to generate future sales leveld ?

Cost Volume Profit Analysis Examples Formula What Is Cvp Analysis

Solved Break Even Sales Under Present And Proposed Conditions Portmann Company Operating At Full Capacity Sold 1 000 000 Units At A Price Of 1 Course Hero

Evaluate other sales capacity factors This is a pretty good balance, but there's more you can look at in your analysis For example, you may already know that your sales people close % of the leads they meet, but that it takes two meetings on average to get there Martin Aerospace is currently operating at full capacity based on its current level of assets Sales are expected to increase by 45 percent A firm's net working capital and all of its expenses vary directly with sales The firm is operating currently at 96 percent of capacityWhat is the full capacity level of sales My interest in best practices of aligning sales and marketing began when our Latin American sales team grew a ton in just a few weeks Suddenly, communication between sales and marketing (nicknamed

7 1 Capacity Planning Saylor Bus300 Operations Management

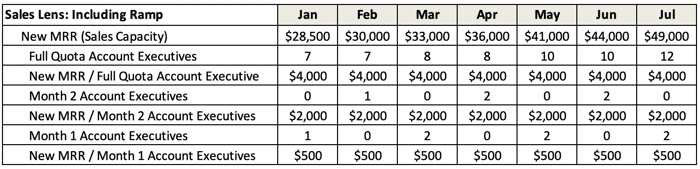

Matching Sales Capacity With Demand Gen Using A Bottoms Up Growth Model

Godrej Appliances Sales Reach Pre Covid Level Expect Full Capacity Utilisation By Sep Business

Excess Capacity Williamson Industries Has 5 Bilion Chegg Com

Eternit Relatorio Anual 10

Sales And Operations Planning

Financial Management Pdf Mortgage Loan Interest

When Ceos Make Sales Calls

Solved Full Capacity Sales Actual Sales Percentage Of Chegg Com

2

Building Your First Sales Capacity Pipeline Requirement Plan By Around The Bonfire Medium

The Owner Of Miller Restaurant Is Disappointed Because The Restaurant Has Been Averaging 7 500 Pizza Brainly Com

Williamson Industries Has 7 Billion In Sales And 1 944 Bill Quizlet

Sales Capacity Assessment Suite Hiring Report

Tpg17 Chapter Ii Annex I Paragraph 4 Tpguidelines Com

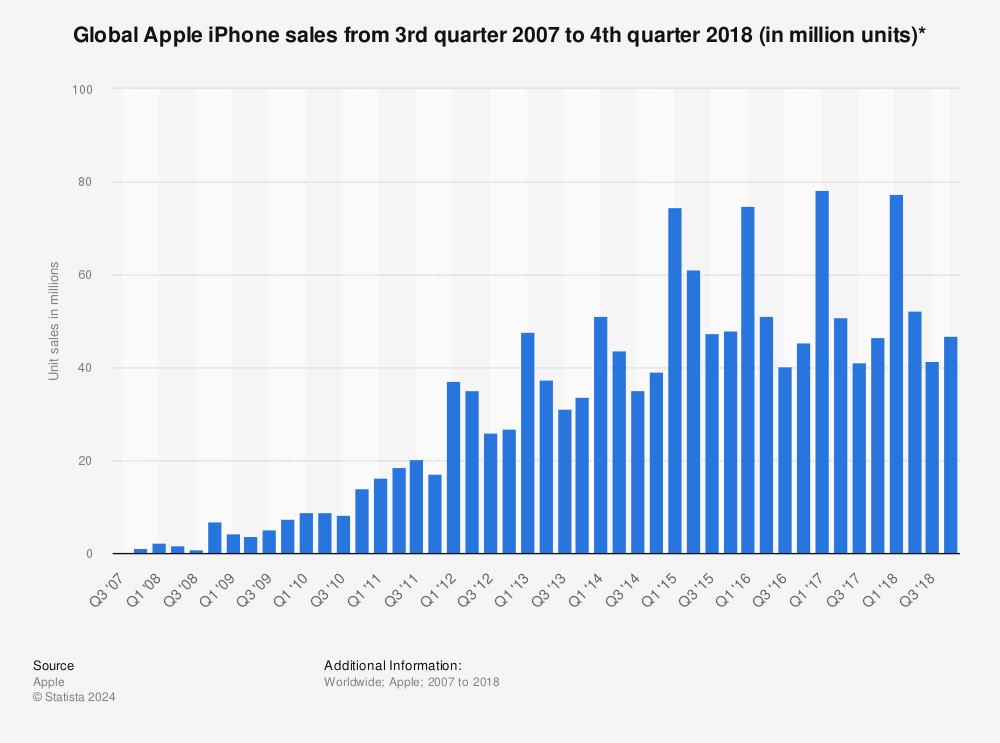

Tsmc Predicts That 5g Phone Sales Could Hit 300 Million Units Next Year Gizmochina

Sales Assessment For Sales Team Capacity Score Selling Sales Training

11 Sales Metrics That Highly Productive Teams Track

Fin Ch4 Questions 2 C4 Q2 Chapter 4 Long Term Financial Planning And Corporate Growth Studocu

Problem 3 19 Full Capacity Sales The Discussion Of Chegg Com

Iphone Sales By Quarter Statista

Chapter 4 Longterm Financial Planning And Growth Mc

5 Steps To Build An Accurate Restaurant Sales Forecast In 21

The Impact Of Covid 19 On Sales And Production The Cpa Journal

Turing People Count Automated Occupancy Intelligence

Energies Free Full Text Bi Level Capacity Planning Of Wind Pv Battery Hybrid Generation System Considering Return On Investment Html

Thedocs Worldbank Org

Break Even Point

Determine The Amount Of Sale Units That Wpuld Be Necessary Under Break Even Sales Present And Proposed Homeworklib

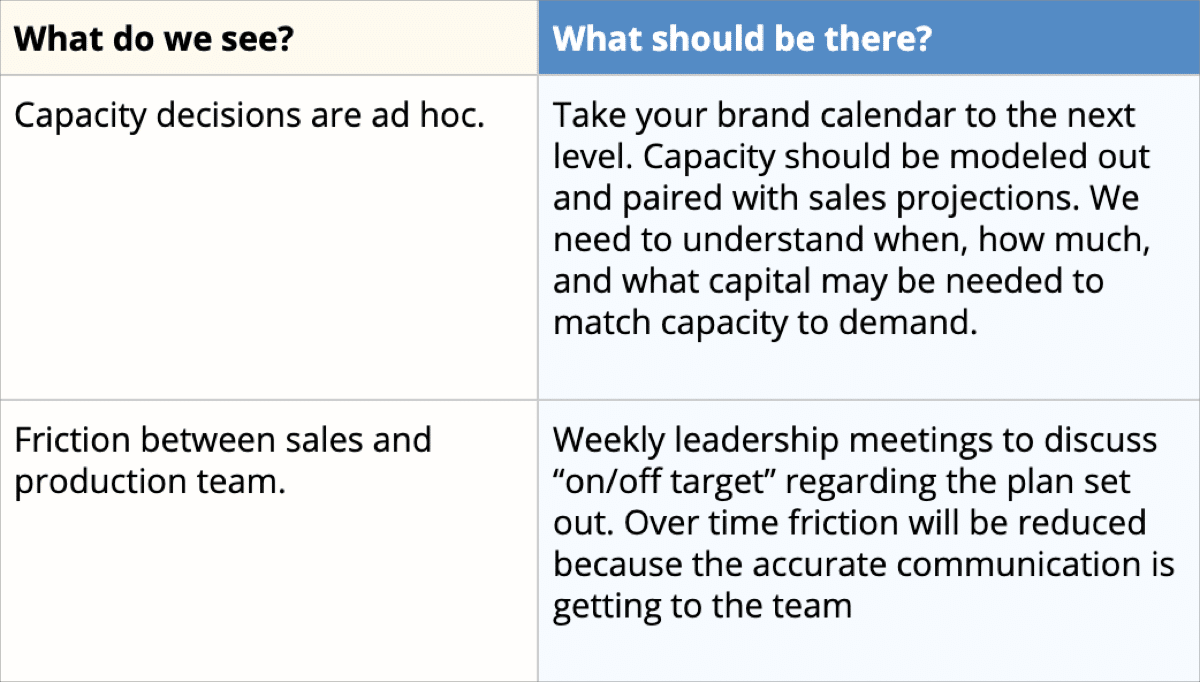

6 Strategies For When Sales Hit Production Capacity

Award 100 Point Bk Metals Is Currently Operating At Full Capacity The Profit Course Hero

When Ceos Make Sales Calls

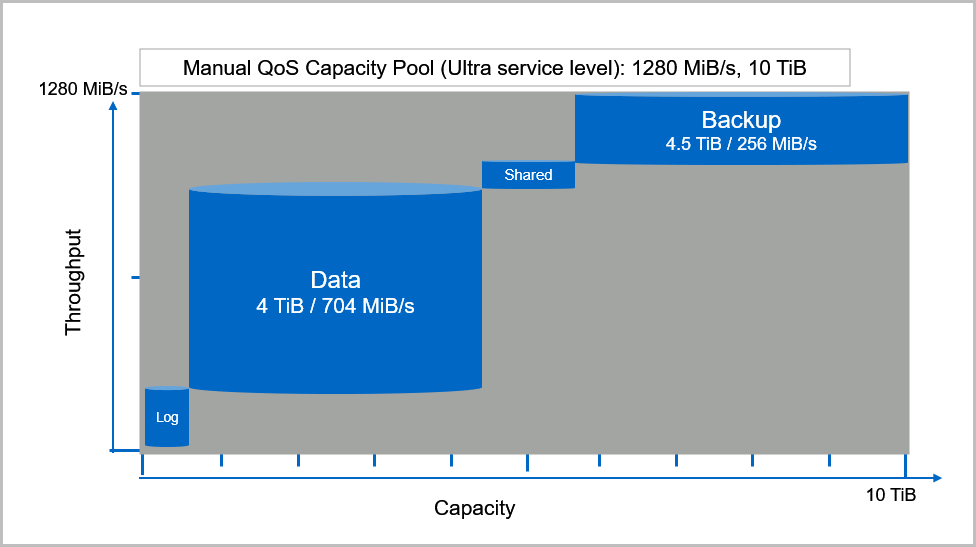

Service Levels For Azure Netapp Files Microsoft Docs

German Onshore Wind Power Output Business And Perspectives Clean Energy Wire

How To Increase Sales Team Capacity Openview Labs

Sales Commission Structures Everything You Need To Know Xactly

A A Creditor To Whom A Firm Currently Owes Money B Any Person

Ppt Long Term Financial Planning And Growth Powerpoint Presentation Free Download Id

How Sales Digitalization Disrupts The Steel Milling Industry

Godrej Appliances Plans To Reach Full Production Capacity From August Sales Already At Pre Covid Level The Economic Times

5nplus Com

Investing Hut A Twitter Ultramarines Pigments Limited A Global Top 3 Supplier Of Blue Pigment Focusing On Export Of Surfactants Now Highly Undervalued Re Rating Candidate Investing

Solved Break Even Sales Under Present And Proposed Conditions Howard 1 Answer Transtutors

Answered Break Even Sales Under Present And Bartleby

Otc Tools 5093b Parts List Operating Manual Pdf Download Manualslib

Sales Commission Structures Everything You Need To Know Xactly

Sales Capacity Team Assessments Team Competency Summary Report Sales Skills Proficiency Level Disc Assessment

A Main Goal Satisfaction B Cash Level Status C Sales Orders Download Scientific Diagram

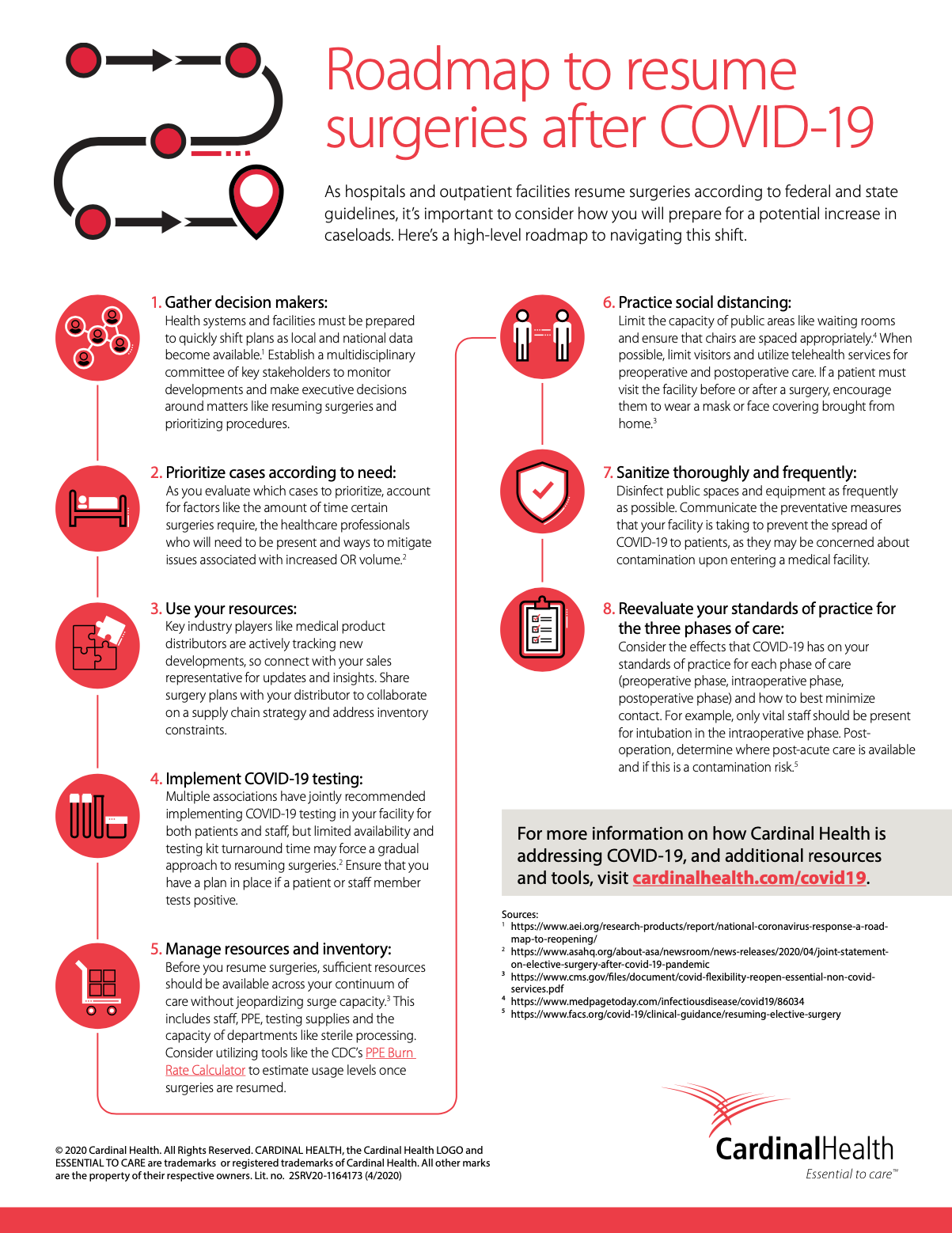

Roadmap To Resume Surgeries After Covid 19

How To Do Annual Sales Capacity Planning

Cost Of Sales Formula Calculator Examples With Excel Template

Long Term Financial Planning And Growth Ch 4

Covid 19 Is A Persistent Reallocation Shock Bfi

Capacity Utilization Rate Formula Calculator Excel Template

Exam 1 With Answers On Intermediate Financial Management Fin 470 Docsity

South African Government Happy Saturday A Reminder That Gatherings Are Permitted Indoor Gatherings Maximum Capacity Is 250 People And For Outdoor Capacity Is 500 People Also You Still Need

Covid 19 Is A Persistent Reallocation Shock Bfi

A Look Inside Part 3 The Typical Brewery S Distribution And Operations Small Batch Standard

Capacity Utilization Definition Example And Economic Significance

Sales Capacity Planning Get The Most Out Of Your Sales Team Espatial

Accounting Help Hungry Howie S Is Currently Operating At 96 Percent Of Capacity The Profit Margin And The Dividend Payout Ratio Are Projected To Remain Constant

Godrej Appliances Sales Reach Pre Covid Level Expect Full Capacity Utilisation By September Indiaretailing Com

Answered 12 Williamson Industries Has 7 Bartleby

2

10 Jack S Currently Has 798 0 In Sales And Is Chegg Com

Why Sales Capacity Matters Steve Rietberg

Long Term Financial Planning And Growth Ppt Video Online Download

Chapter 4 Longterm Financial Planning And Growth Mc

M3 Activity 1 Pdf Retained Earnings Dividend

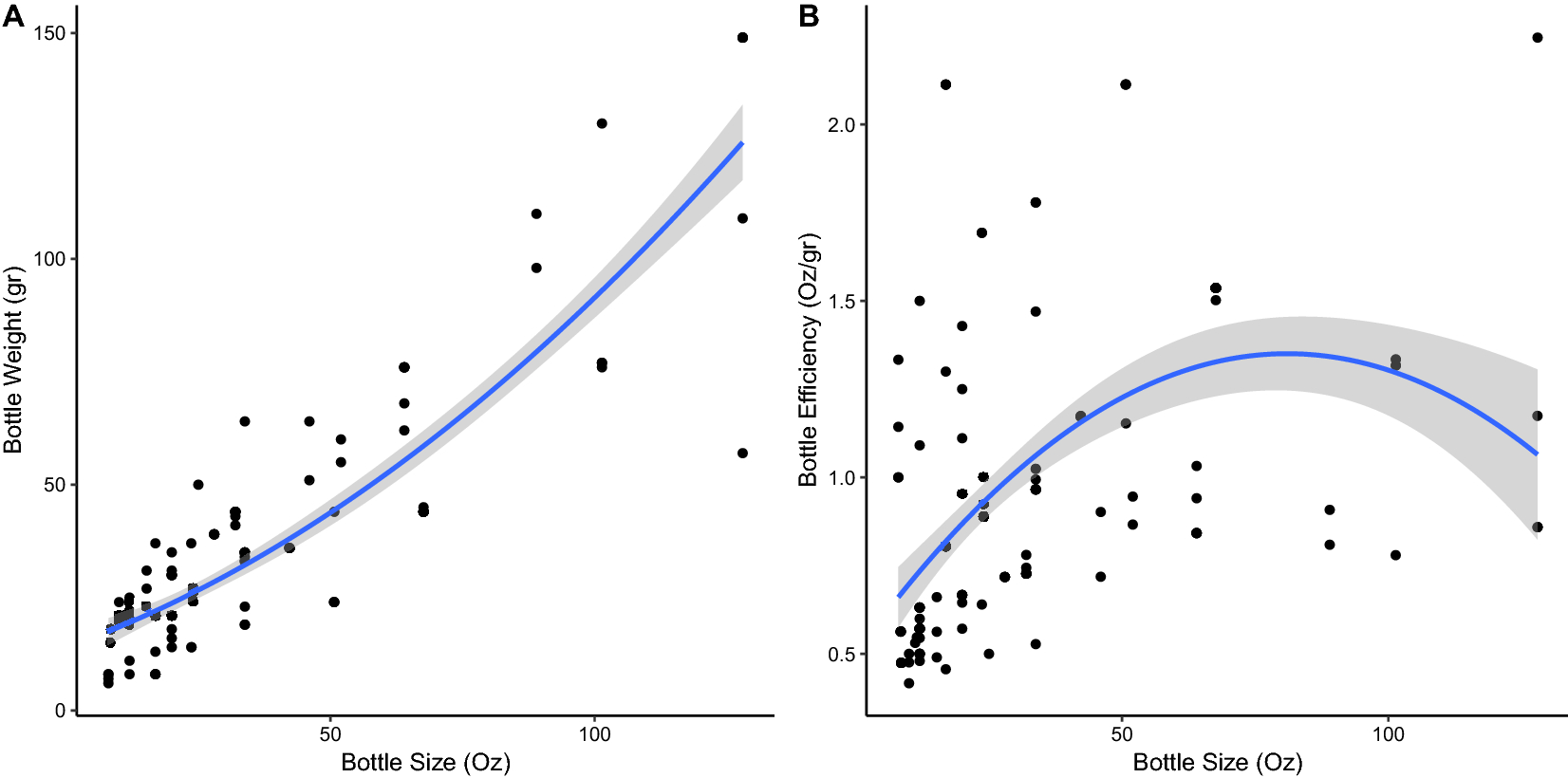

Beverage Bottle Capacity Packaging Efficiency And The Potential For Plastic Waste Reduction Scientific Reports

1

Accounting Help Hungry Howie S Is Currently Operating At 96 Percent Of Capacity The Profit Margin And The Dividend Payout Ratio Are Projected To Remain Constant

1

A Main Goal Satisfaction B Cash Level Status C Sales Orders Download Scientific Diagram

Create A Measure That Counts An Aggregated Result Microsoft Power Bi Community

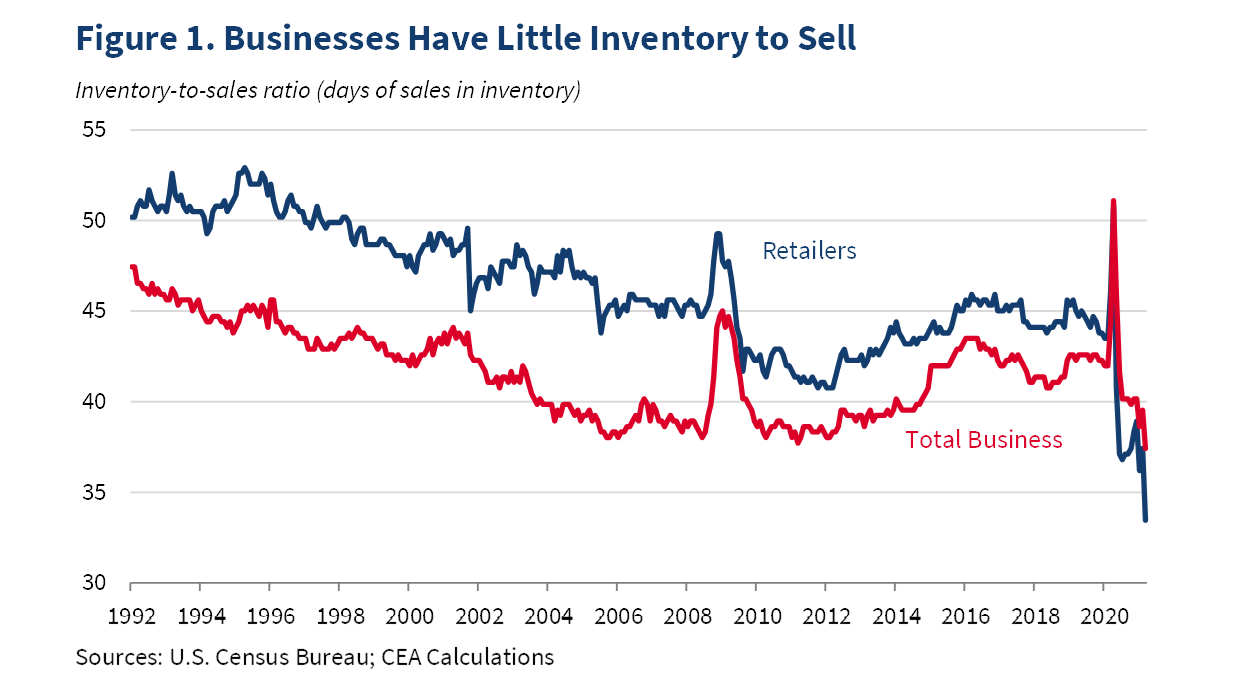

Why The Pandemic Has Disrupted Supply Chains The White House

Corporate Finance Asia Global 1st Edition Ross Solutions Manual

Plowback And Dividend Payout Ratios Your Company Has

Solved Excess Capacity Williamson Industries Has 7 Billion In Sales And 2 8 Billion In Fixed Assets Currently The Company S Fixed Assets Are Op Course Hero

0 件のコメント:

コメントを投稿